This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities that enable him to record and manage employee contributions, as well as those levied on customs importation, third parties, treasury, or value added tax (VAT). It also explains how to transfer the deductions of one or more withholdees and how to produce reports.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities that enable him to record and manage employee contributions, as well as those levied on customs importation, third parties, treasury, or value added tax (VAT). It also explains how to transfer the deductions of one or more withholdees and how to produce reports.

The TIN, the tax account and the tax period must be associated with the tax type corresponding to the withholdings listed below, otherwise the user cannot access the details of the deductions.

The 5 types of withholdings supported by SIGTAS are:

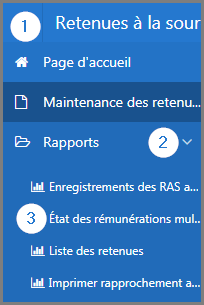

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Withholdings module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, as they apply the same way to all pages in all modules. However, these functionalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access the guides, click on the following link:

• Maintain WithholdingsSIGTAS provides users with a series of interactive reports allowing to generate data according to various parameters. To learn how to generate and print interactive reports, click on the following link Reports.

To access the reports:

The reports in the Withholdings module are: