Calculate penalties and interest on opening arrears

This part of the guide explains how to calculate penalties and interest on opening arrears.

This page contains some validations. Click the following link for more information: Calculate penalties and interest on opening arrears - Configuration details

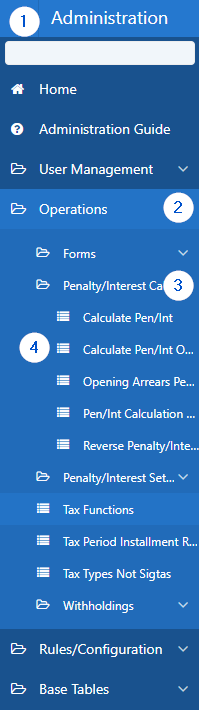

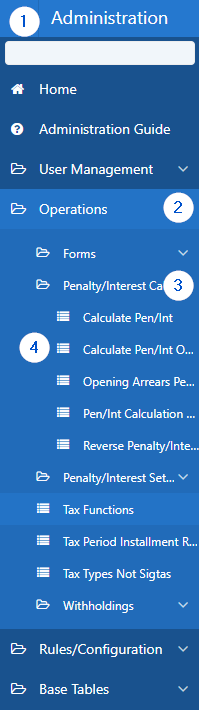

Step 1 - Go to the Calculate Penalty and Interest on Opening Balances page

- Go to the Administration module;

- Choose the Operations option;

- Select the Penalty and Interest Calculation option;

- Click the menu Calculate Pen/Int Opening Balance. This action opens the Calculate Penalty and Interest on Opening Arrears page (509:15240);

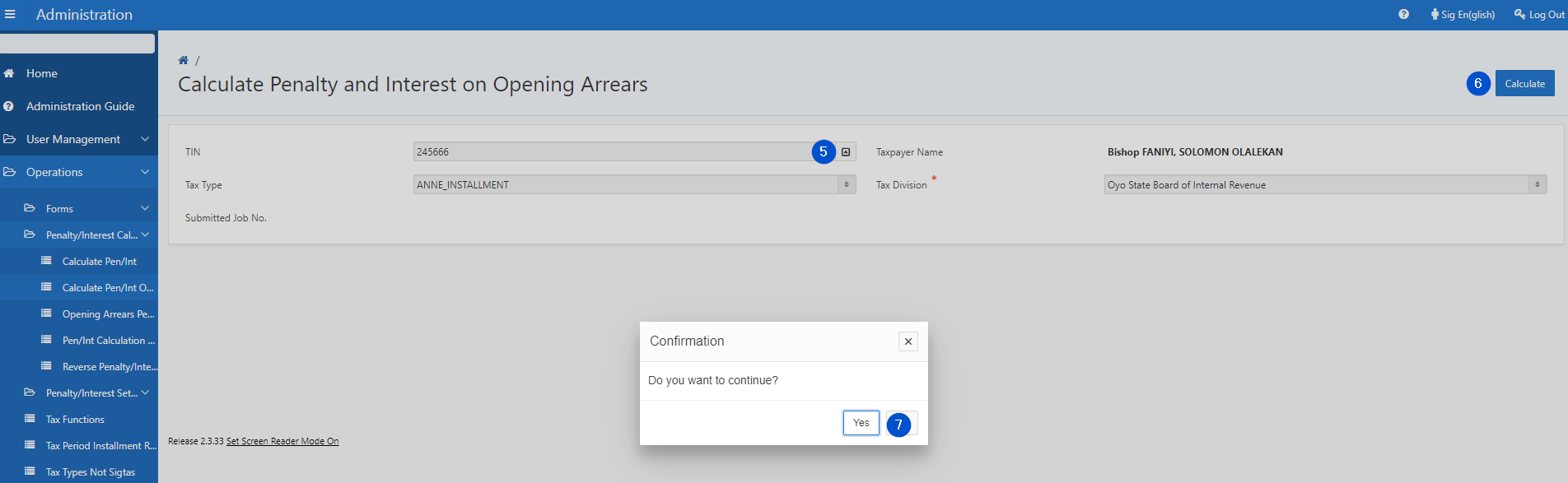

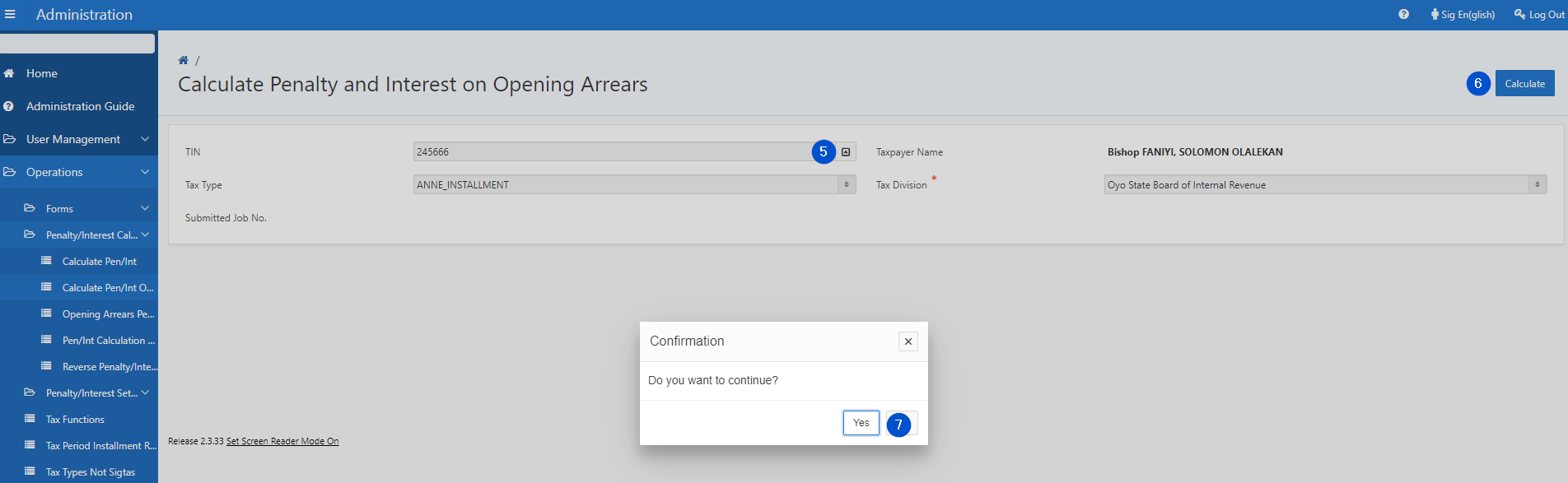

Step 2 - Calculate penalties and interest on opening balance

- Fill out the required fields (identified with a red star *). For example, Tax Division, etc.;

- Click the Calculate button. This action opens the confirmation window;

- Click the Yes button. This action confirms the calculation of penalties and interest on opening balance and displays the Summary Report button.

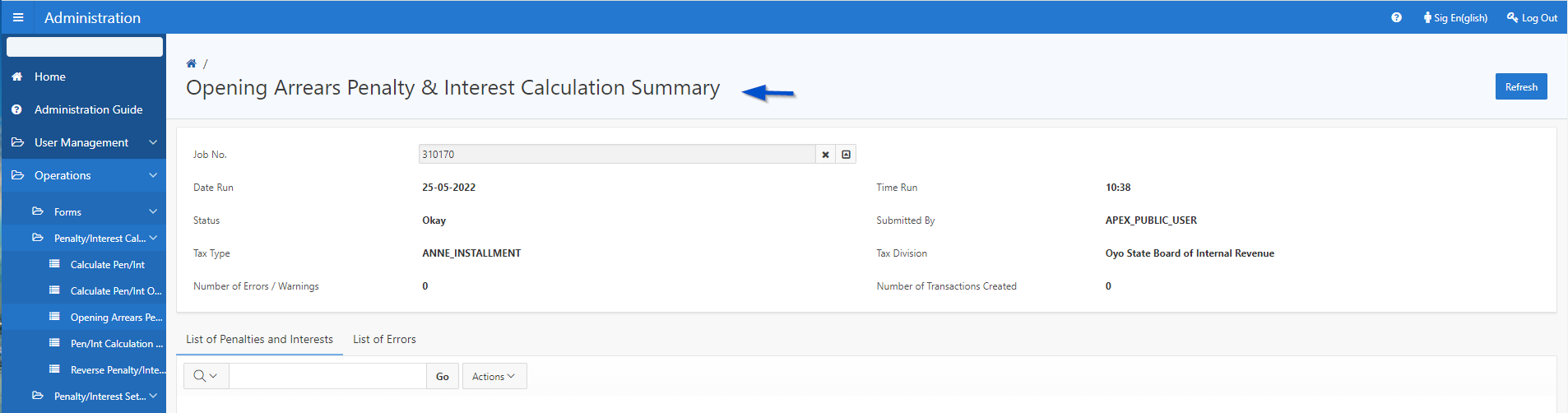

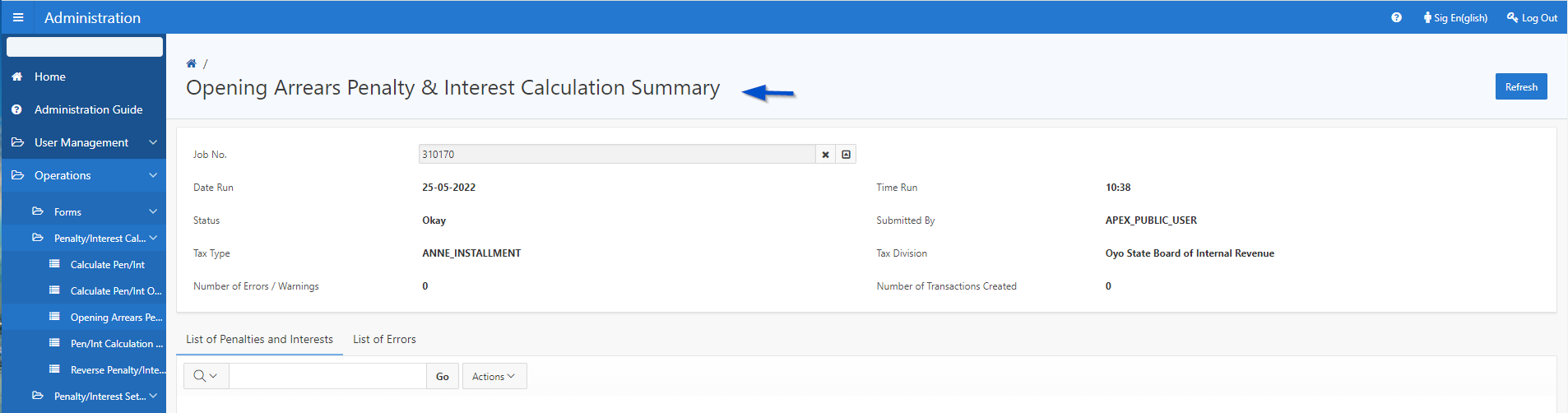

- Click on the Summary Report button. This action opens the Opening Arrears Penalty & Interest Calculation Summary page (509:14440).