Add a withholdee

This part of the guide explains how to add a withholder. Make sure the TIN, the tax account and the tax period are associated with the tax type corresponding to the withholdings you want to transfer. In this example, it corresponds to the PAYE withholdings.

SIGTAS supports 5 types of withholdings, those related to employee contributions (PAYE), custom imports, third parties, treasury and value added tax (VAT). The user must associate the corresponding tax type with the withholdings listed above, to interact on this page.

The following example shows how to add a withholdee with a PAYE type withholding. This procedure is standardized and applies also to the other types of withholdings, either custom imports, third parties, treasury or value added tax (VAT).

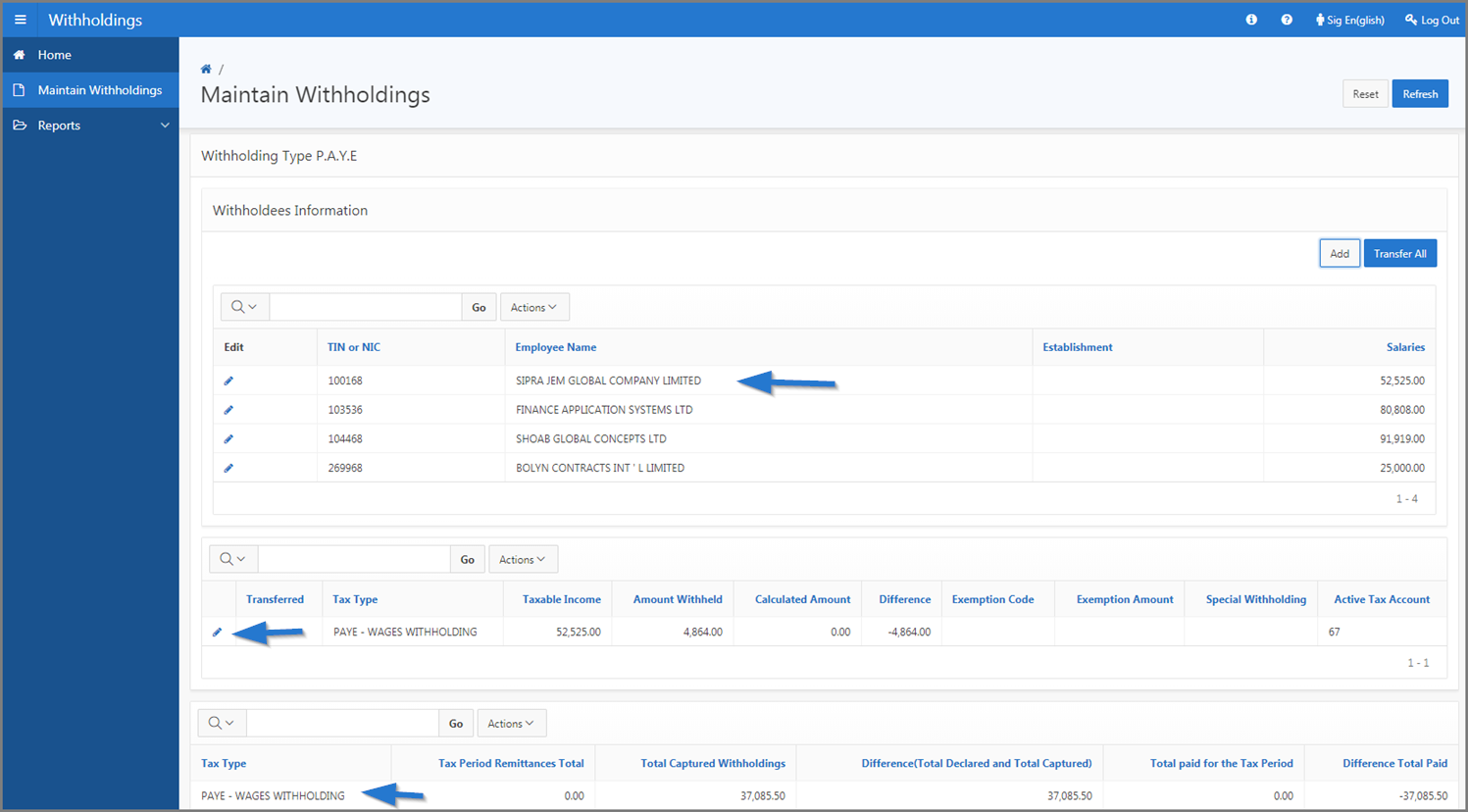

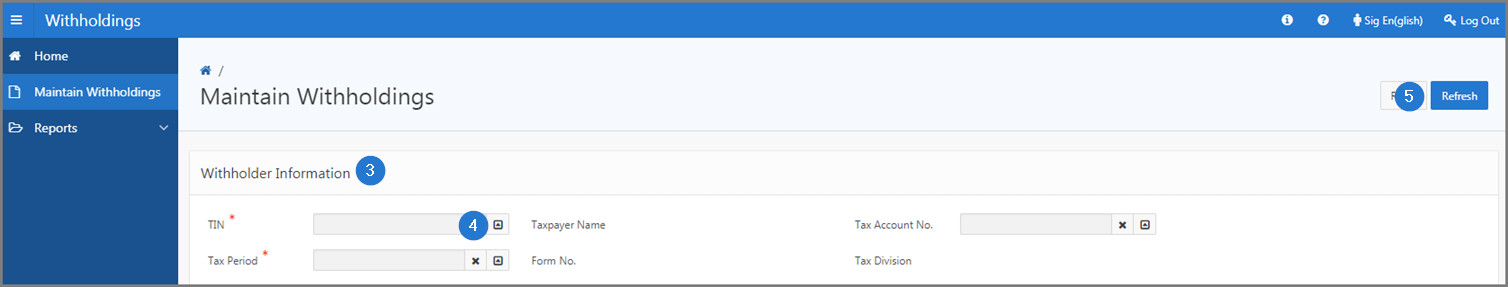

Step 1 - Go to the page Maintain Withholdings

- Go to the Withholdings module;

- Choose the Maintain Withholdings menu. This action opens the Maintain Withholdings page (517:2004);

Step 2 - Add a withholdee

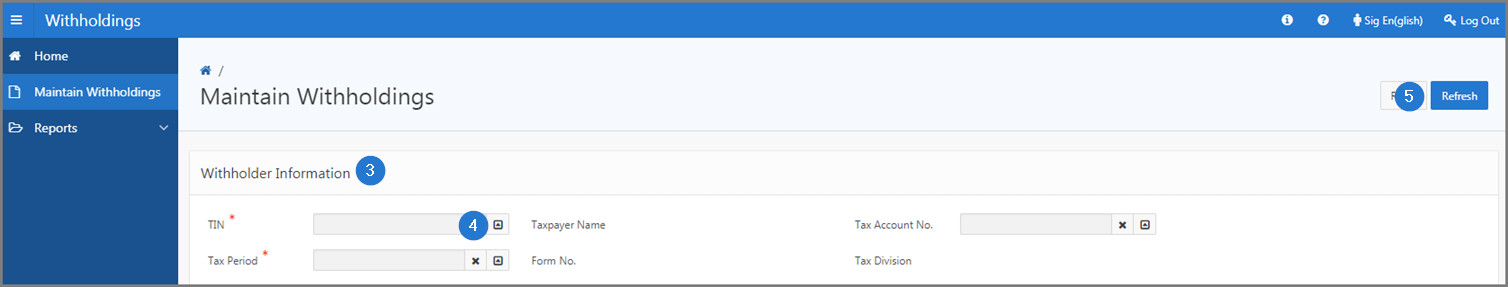

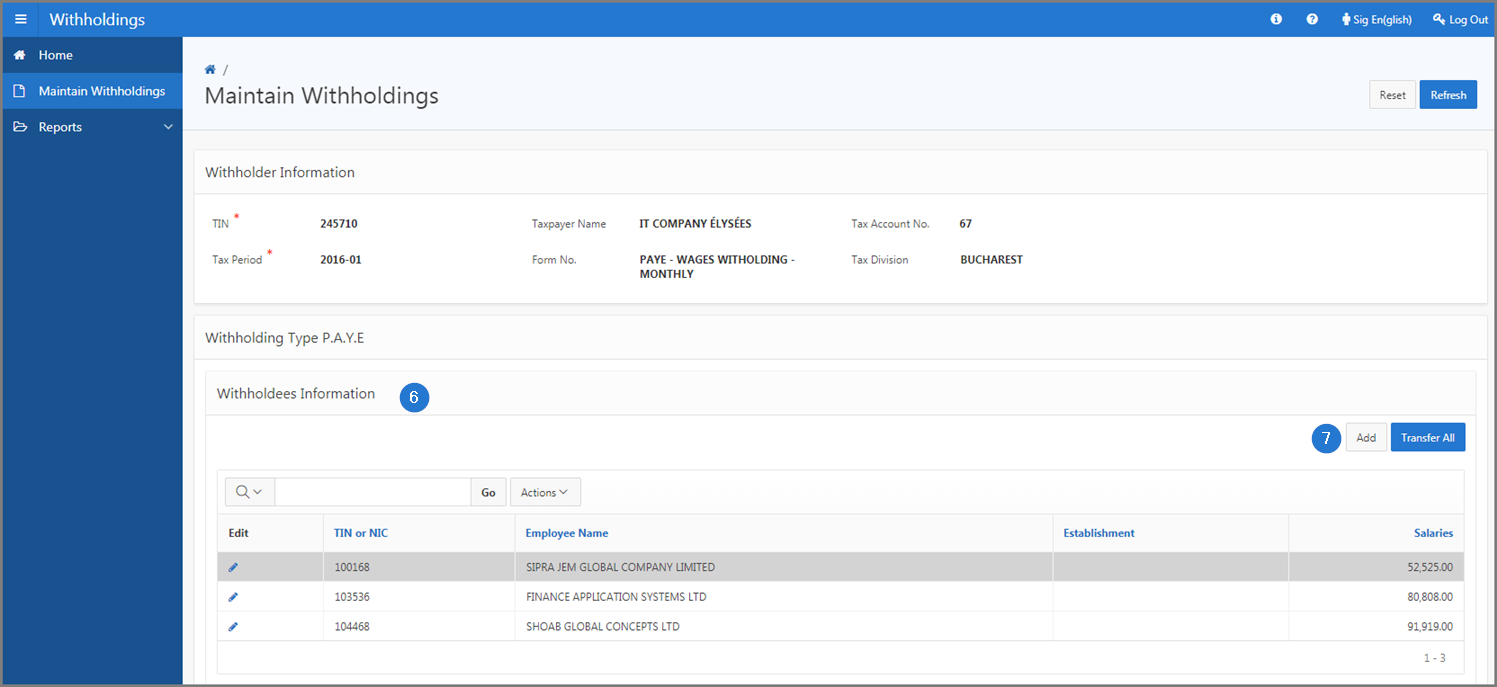

- Go to the Withholder Information section;

- Fill out the required fields (identified by a red asterisk *). For example, TIN, Tax Period, etc. Make sure the TIN, the tax account and the tax period are associated with the tax type corresponding to the PAYE withholdings;

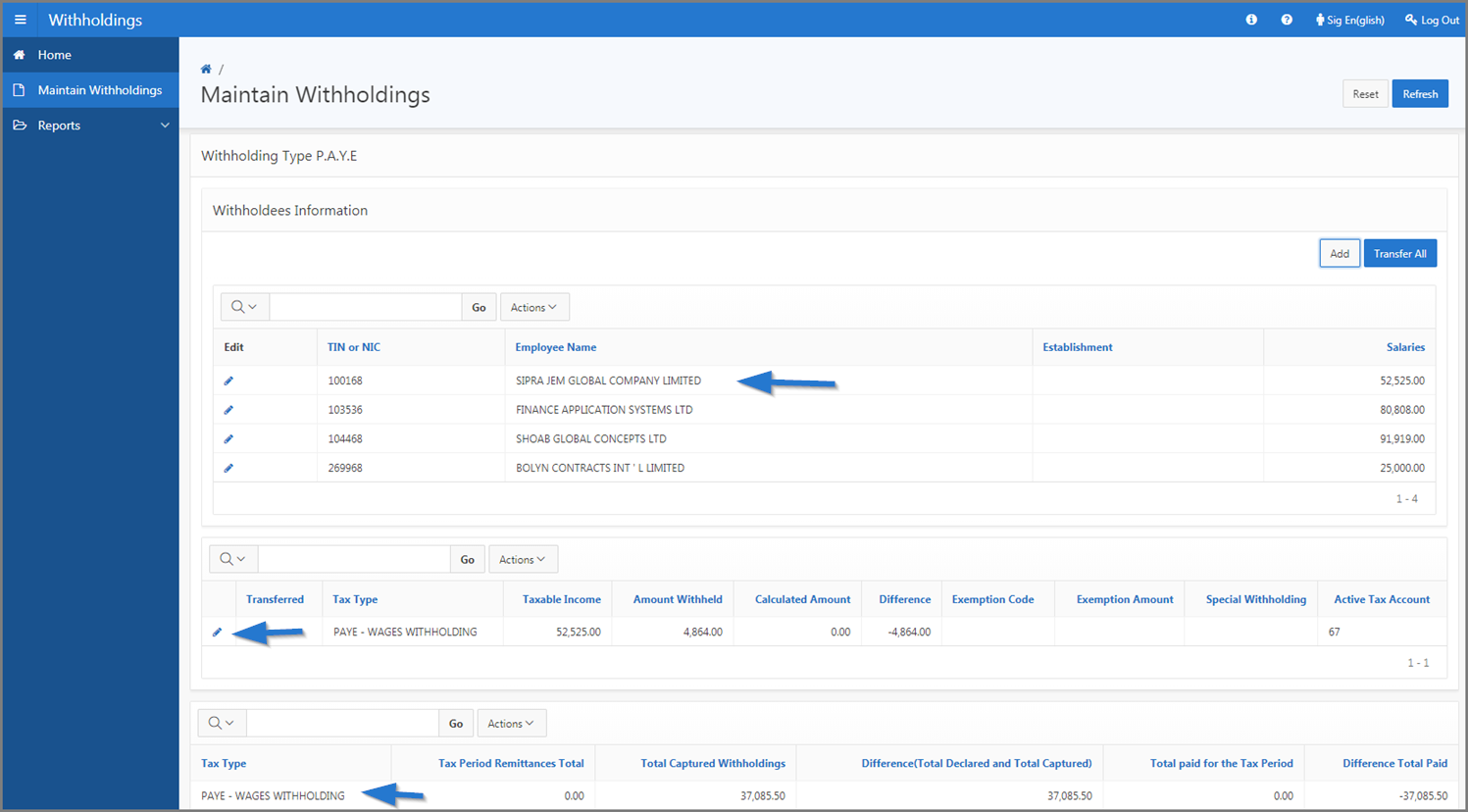

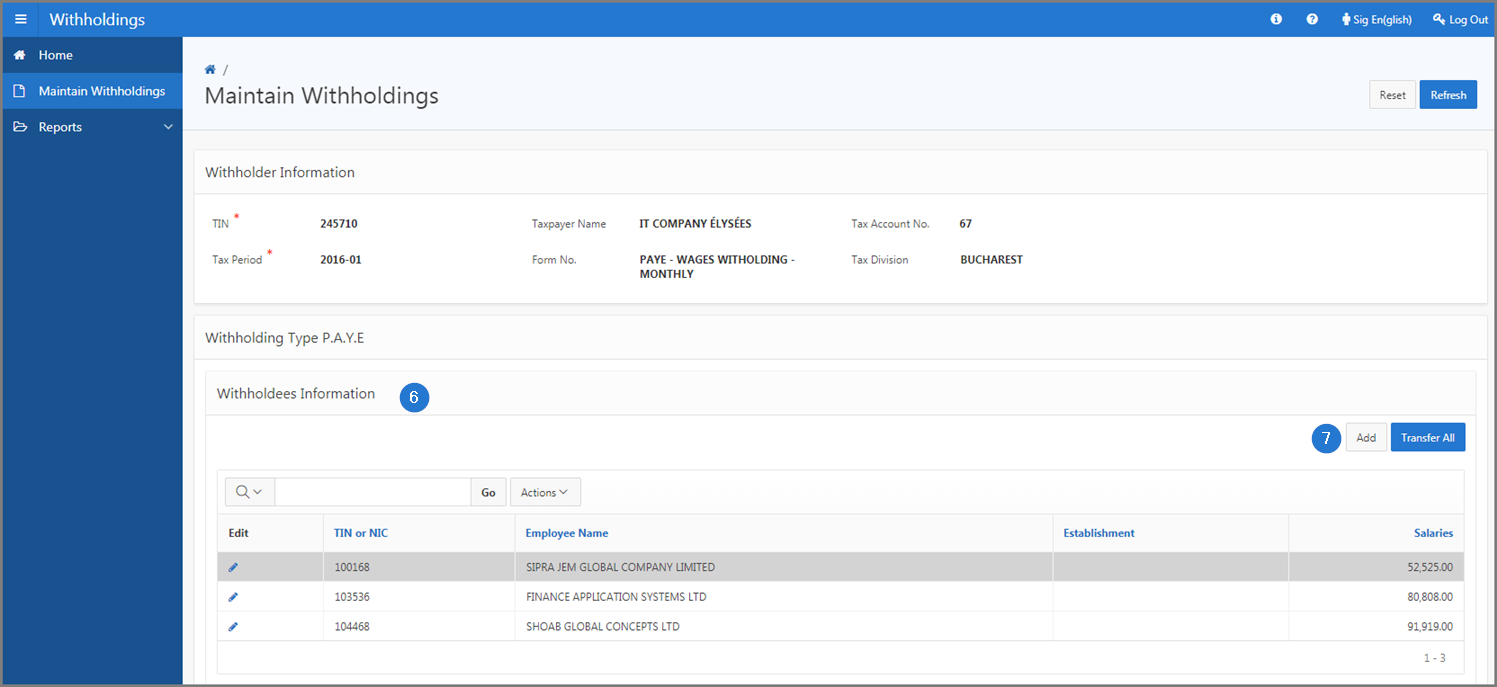

- Click the Refresh button. This action refreshes the Maintain Withholdings page (517:2004) and displays PAYE deductions details in the lower section;

- Go to the section Withholdees Information;

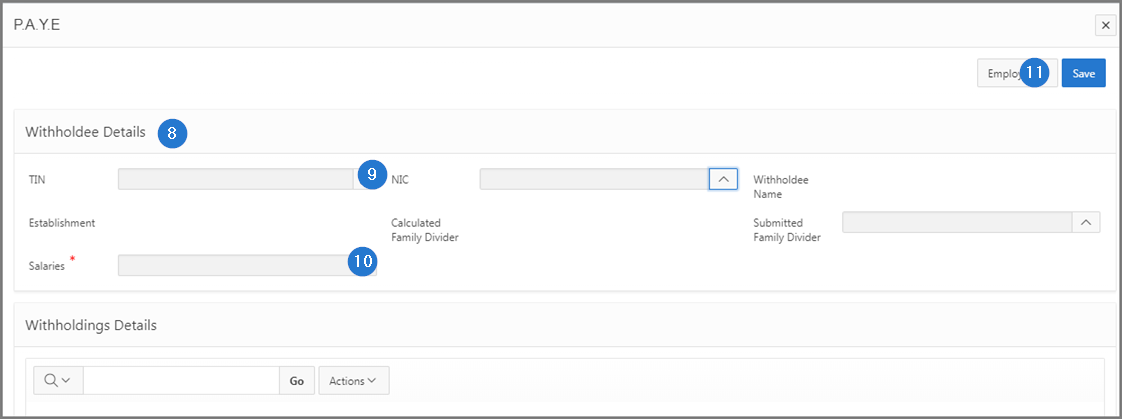

- Click the Add button. This action opens the pop-up window P.A.Y.E.;

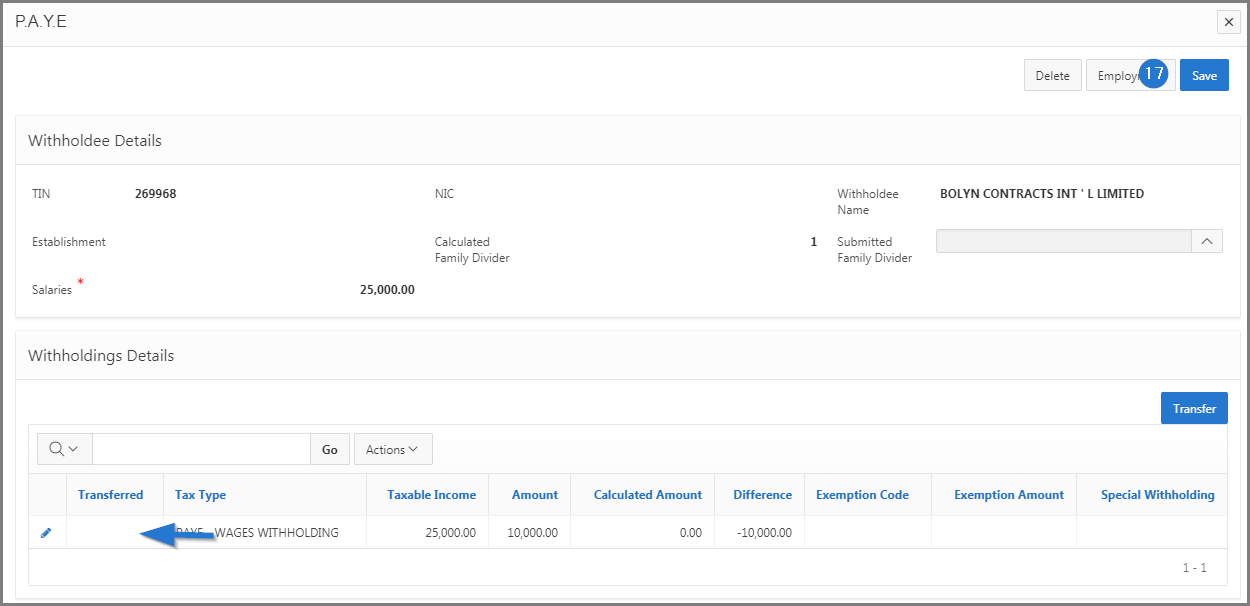

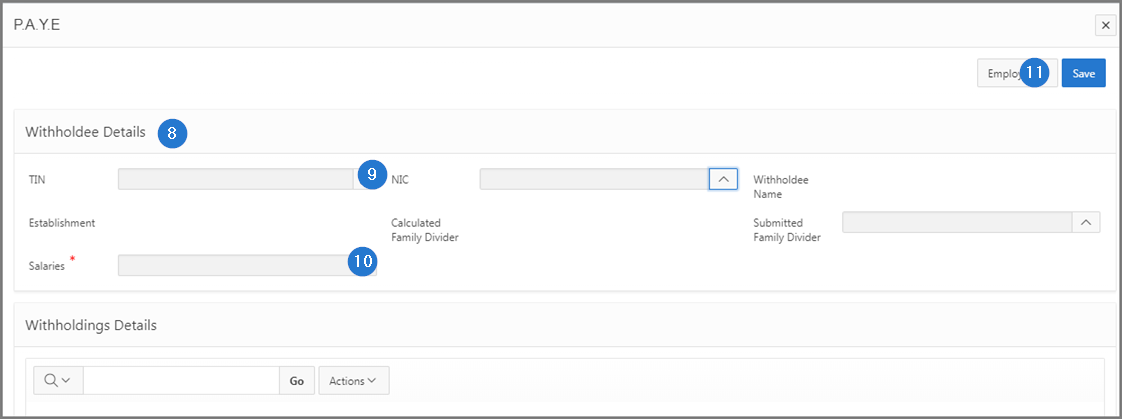

- Go to the Withholdee Details section;

- Enter the TIN and the NIC, if required;

- Fill out the required fields (identified by a red asterisk *). For example, Salaries;

- Click the Save button. This action confirms the addition of the withholdee, refreshes the pop-up window P.A.Y.E. and displays the Withholdings Details section;

- Go to the section Withholdings Details;

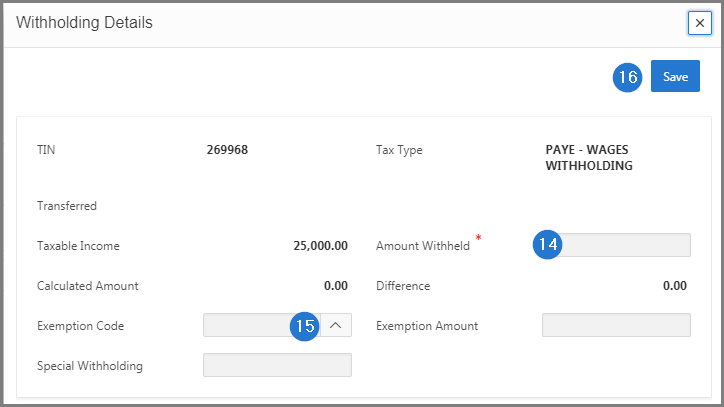

- Click the Add button. This action opens the pop-up window Withholding Details;

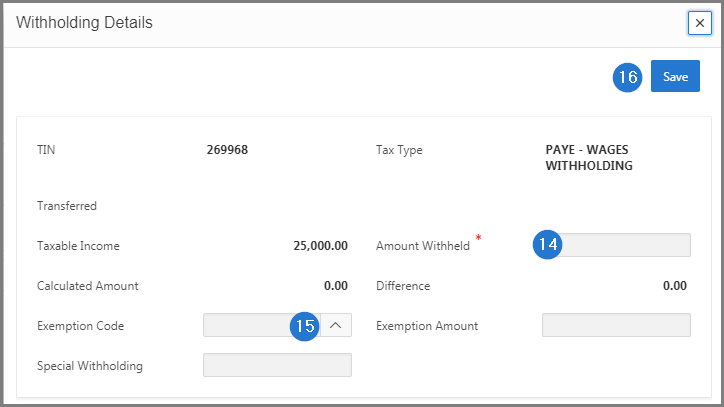

- Fill out the required fields (identified by a red asterisk *). For example, Amount Withheld;

- Add an Exemption Code, as the case might be;

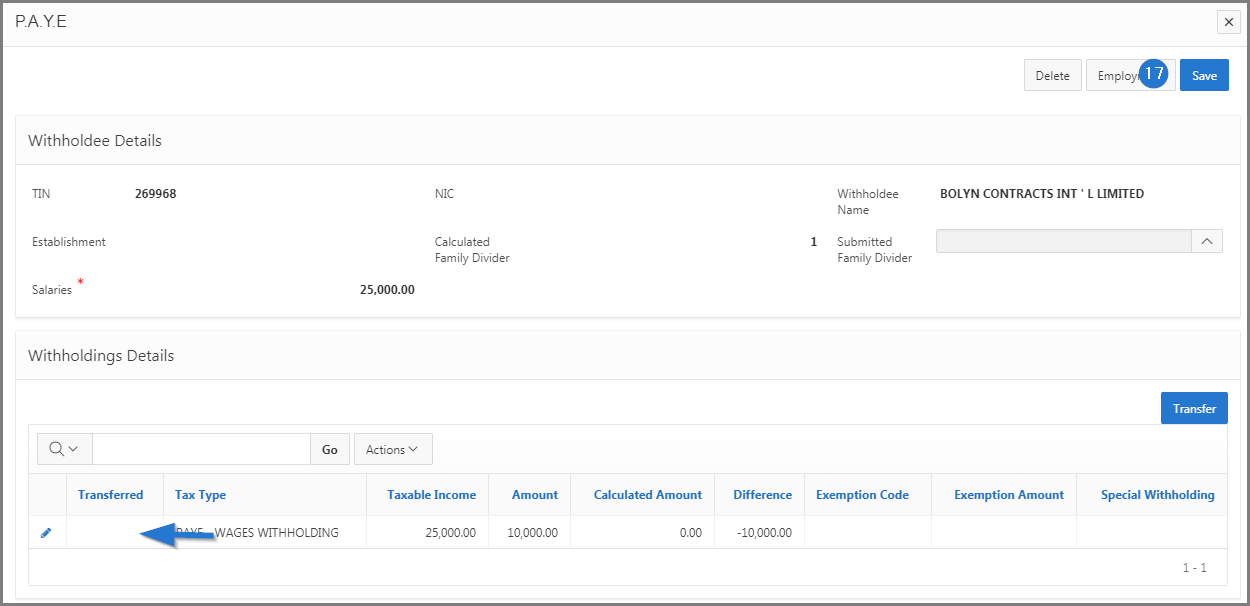

- Click the Save button. This action confirms the addition of the withholdee and refreshes the pop-up window P.A.Y.E.

- Click the Save button. This action confirms the addition of the withholding details and redirects you to the Maintain Withholdings page (517:2004).