This part of the guide explains how to display the specific rules.

When registering a taxpayer in the Tax Roll module, SIGTAS assigns a sequential TIN number. This TIN becomes final only when all the registration steps have been completed. This procedure allows the validation of the TIN number sequence.

For example, if during the process, certain changes are made to the application, the TIN will be lapsed and the next sequential number on the list corresponding to the category of change will be assigned. This procedure will continue until the application is validated and approved by the supervisor. The final TIN is then assigned. This procedure varies from jurisdiction to jurisdiction, depending on the applicable regulation.

This rule is applied from the TIN Generation tab.

The following examples illustrate the procedure for allocating TINs in different jurisdictions.

Example I - Jurisdiction applying the validation rule for TIN allocation based on taxpayer subtype.

When you choose the TIN Component Numeric Sequence per Taxpayer Sub Type, SIGTAS displays the sequence details associated with this component. The Business taxpayer subtype is associated with sequence 132099, while the Charity subtype is associated with sequence number 500766, and so on.

Example II - Jurisdiction not applying the TIN allocation validation rule based on the taxpayer subtype

The same rule applies to the individual taxpayer, the only exception being that the validation of the TIN is not based on the type of business, but on the subtype and the ID type.

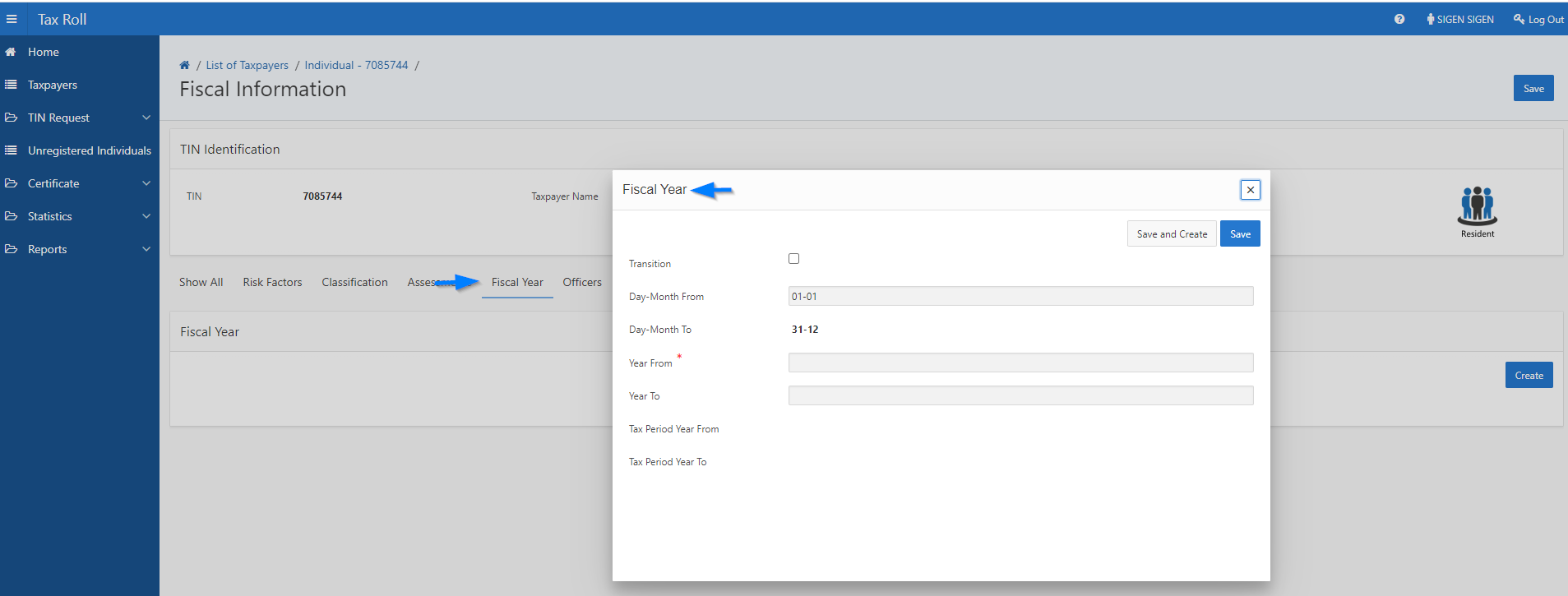

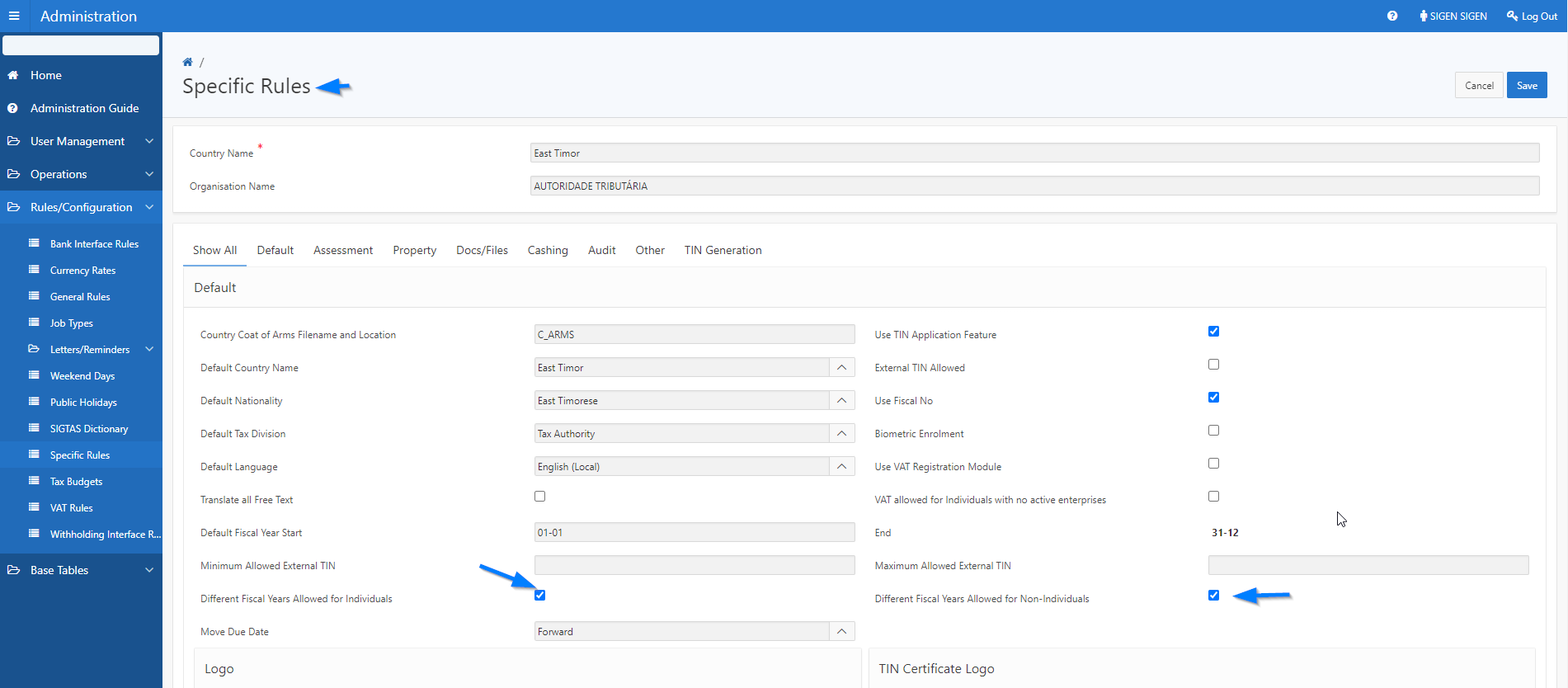

This page also allows to detail fiscal years according to tax periods.

When both fields Different Fiscal Years Allowed for Individuals and Different Fiscal Years Allowed to Non-Individuals fields are checked, it means that you can detail the fiscal year according to tax periods.

In the Tax Roll module, the Fiscal Years tab is available, and the user can capture details.