Assessment Module

This guide is intended primarily for the SIGTAS user. It details the procedures and functionalities needed to process tax returns and to calculate taxpayers' contributions. It allows the capture and the updating of reassessments and estimated assessments. In this module, the user can not only create and modify notices to be sent to the taxpayers, send notices to the defaulters regarding late payment or non-filing of assessments within the deadlines but also produce assessments, failures and overpayments reports, etc. This module also allows the user to manage projects under specific conditions, including the registration of local and international invoices, as appropriate.

This guide is intended primarily for the SIGTAS user. It details the procedures and functionalities needed to process tax returns and to calculate taxpayers' contributions. It allows the capture and the updating of reassessments and estimated assessments. In this module, the user can not only create and modify notices to be sent to the taxpayers, send notices to the defaulters regarding late payment or non-filing of assessments within the deadlines but also produce assessments, failures and overpayments reports, etc. This module also allows the user to manage projects under specific conditions, including the registration of local and international invoices, as appropriate.

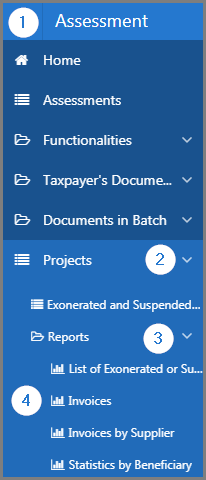

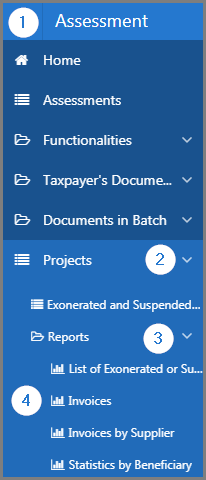

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Assessment module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting since they apply the same way to all pages. However, these functionnalities are described in more detail in the Close, Edit, or Delete in SIGTAS section of the About SIGTAS guide.

To access the guides, click the corresponding link:

• Assessments

• Documents in batch

• Exonerated and Suspended Projects

• Functionalities

• Statistics

• Taxpayer Documents

Reports

SIGTAS provides users with a set of interactive reports allowing the user to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports. This module includes two sets of reports. The first set concerns the reports associated to the Projects sub-section. While the second addresses the reports pertaining directly to the Assessment module.

To access the reports of the Projects sub-section:

- Go to the Assessment module;

- Choose the Projects option;

- Click on the Reports menu;

- Click on the report of your choice.

The reports of the Projects sub-section are:

- Cancelled Invoices. This interactive report displays cancelled invoices based on various search criteria, such as Visa No., Visa Date, etc. (502:10016);

- Invoices. This report is used to print invoices according to various search criteria, such as, Invoices For, Project No., etc. (502:10005);

- Invoices by Supplier. This interactive report displays invoices by suppliers based on various search criteria, such as Supplier TIN, Date Visa From, etc. (502:10006);

- List of Exonerated or Suspended Projects. This report is used to print the exonerated or suspended projects according to various search criteria, such as, TIN, Taxpayer Name, etc. (502:10001);

- Revenue by Activity Sector / Suspension. This interactive report displays the revenue by activity sector based on various search criteria, such as Activity Sector, Date Visa From, etc. (502:10010);

- Revenue by Exoneration Type. This interactive report displays the revenue by exoneration type based on various search criteria, such as Beneficiary TIN, Exoneration Type, etc. (502:10008);

- Revenue by Region. This interactive report displays the revenue by region based on various search criteria, such as Region, Date Visa From, etc. (502:10015);

- Revenue by Tax Division. This interactive report displays the revenue by tax division based on various search criteria, such as Tax Division, Date Visa From, etc. (502:10014);

- Specific Tax Exonerated for a Period. This interactive report displays the specific tax exonerated for a period based on various search criteria, such as Date Visa From, Date Invoice From, etc. (502:10012);

- Statistics by Beneficiary. This interactive report displays statistics by beneficiary based on various search criteria, such as Beneficiary TIN, Beneficiary Name, etc. (502:10007);

- Statistics by Invoice / Exoneration. This interactive report displays statistics by invoice / exoneration based on various search criteria, such as Date Visa From, Date Invoice From, etc. (502:10009);

- VAT Exonerated for a Period. This interactive report displays VAT exonerated for a period based on various search criteria, such as Activity sector, Date Visa From, etc. (502:10011);

- VAT Suspended for a Period. This interactive report displays VAT suspended for a period based on various search criteria, such as Activity Sector, Date Visa From, etc. (502:10013).

To access the reports of the Assessment module:

- Go to the Assessment module;

- Choose the Reports menu;

- Click on the report of your choice.

The reports of the Assessment module are:

- Assessments Comparaison. This interactive report displays the comparison of assessments based on various search criteria, such as Tax Type, Tax Period, etc. (502:8026);

- Assessment Currency Details. This interactive report displays assessment currency details based on various search riteria, such as Assess No., TIN, etc. (502:8027);

- Assessment History. This interactive report displays assessment history based on various search criteria, such as Entry Date, TIN, etc. (502:10024);

- Charges per Type of Penalty. This interactive report displays charges per type of penalty based on various search criteria, such as Tax Division, Tax Type, etc. (502:8014);

- Consolidated Balance Notice. This report is used to print consolidated balance notices according to the Tax division and the Letter Title (502:8023);

- Entered Remittances. This interactive report displays entered remittances based on various search criteria, such as Tax Division, Tax Type, etc. (502:8015);

- Excise Charge Summary. This interactive report displays the excise charge summary based on various search criteria, such as TIN, Taxpayer Name, etc. (502:8008);

- Filers. This interactive report displays filers based on various search criteria, such as Tax Type, Tax Division, etc. (502:8021);

- Form Lines. This interactive report displays form lines based on various search criteria, such as Form Name, IRD Form No., etc. (502:8017);

- Form Version and Periods. This report is used to print form version and periods according to the Form No. and Version No. (502:8019);

- Generic Report File. This report is used to print generic report files according to the TIN, Tax Type, etc. (502:10025);

- Immediate Assessments. This report is used to print immediate assessments according to the Assessment No., Tax Type, etc. (502:8010);

- Immediate Assessment Summary. This interactive report displays an immediate assessment summary based on various search criteria, such as Tax Type, Element Type, etc. (502:8031);

- Income Tax - Payers IMF. This interactive report displays income tax based on various search criteria, such as Tax type, TIN, etc. (502:8003);

- List of Building Tenants. This interactive report displays the list of building tenants based on various search criteria, such as Owner's TIN, Establishment, etc. (502:10029);

- List of Collection Cases. This report is used to print the list of collection cases according to various search criteria, such as TIN, Tax Division, etc. (502:10028);

- List of Input Errors. This interactive report displays the list of input errors based on various search criteria, such as Tax Type, Tax Division, etc. (502:10023);

- List of Installments. This report is used to print the list of installment according to the TIN, Taxpayer Name, etc. (502:8032);

- List of Other Carry-Forward. This interactive report displays the list of carry-forwards based on various search criteria, such as TIN, Tax Period, etc. (502:8028);

- List of Payment Without Statements. This interactive report displays the list of payement without statements based on various search criteria, such as Tax Type, Tax Division, etc. (502:10021);

- List of Remittances. This interactive report displays the list of remittances based on various search criteria, such as Tax Type, Tax Period, etc. (502:8029);

- Manufactured Goods Summary - Excise Taxes. This interactive report displays the manufactured goods summary based on various search criteria, such as TIN, Taxpayer Name, etc. (502:8006);

- List of Non-Filers (No Remittance). This interactive report displays the list of non-filers based on various search criteria, such as TIN , Tax Type, etc. (502:8022);

- Overpayment. This interactive report displays the overpayments based on various search criteria, such as TIN, Taxpayer Name, etc. (502:8012);

- Print Entered Assessments. This report is used to print the entered assessments according to the Batch No. and the Assessment No. (502:10017);

- Print Revenue Foregone. This report is used to print the revenue foregone according to Report and Start Date (502:8025);

- Tax Collection. This interactive report displays the tax collection based on various search criteria, such as Tax Division, Tax Type, etc. (502:8001);

- Taxation Threshold. This interactive report displays the taxation treshold based on various search criteria, such as Tax Division, Tax Type, etc. (502:8002);

- Taxpayer Assessment History. This report is used to print the taxpayer assessment history according to the TIN, Taxpayer Name, etc. (502:8011);

- Taxpayer Account Summary By Tax Period. This report is used to print the taxpayer account summary according to the TIN, Tax Division, etc. (502:10020);

- Tax Periods Without Assessments. This interactive report displays tax periods without assessments based on various search criteria, such as TIN, Taxpayer Name, etc. (502:8013);

- Transaction Distribution Report. This interactive report displays a transaction distribution report based on various search criteria, such as Tax Division, Tax Division Children, etc. (502:8030);

- Unliquidated Statements. This interactive report displays unliquidated statements based on various search criteria, such as Tax Type, Tax Period, etc. (502:8020).

- Census Tenants This report displays the census tenants, based on the owner's TIN, the years, etc...(502:10032)

This guide is intended primarily for the SIGTAS user. It details the procedures and functionalities needed to process tax returns and to calculate taxpayers' contributions. It allows the capture and the updating of reassessments and estimated assessments. In this module, the user can not only create and modify notices to be sent to the taxpayers, send notices to the defaulters regarding late payment or non-filing of assessments within the deadlines but also produce assessments, failures and overpayments reports, etc. This module also allows the user to manage projects under specific conditions, including the registration of local and international invoices, as appropriate.

This guide is intended primarily for the SIGTAS user. It details the procedures and functionalities needed to process tax returns and to calculate taxpayers' contributions. It allows the capture and the updating of reassessments and estimated assessments. In this module, the user can not only create and modify notices to be sent to the taxpayers, send notices to the defaulters regarding late payment or non-filing of assessments within the deadlines but also produce assessments, failures and overpayments reports, etc. This module also allows the user to manage projects under specific conditions, including the registration of local and international invoices, as appropriate.