Modify a tax schedule

This part of the guide explains how to modify a tax schedule of an assessment.

The modification of a tax schedule is only possible when its status displays Not-Up-To-date. Once the schedule has been modified, its status stays the same.

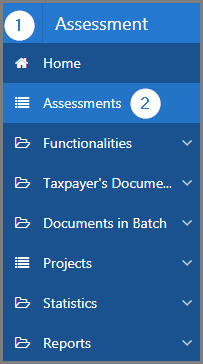

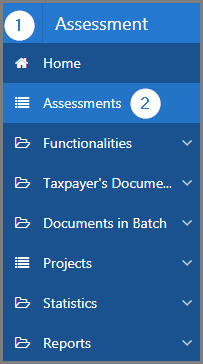

Step 1 - Go to the page List of Assessments

- Go to the Assessment module;

- Choose the Assessments menu. This action opens the List of Assessments page (502:1001);

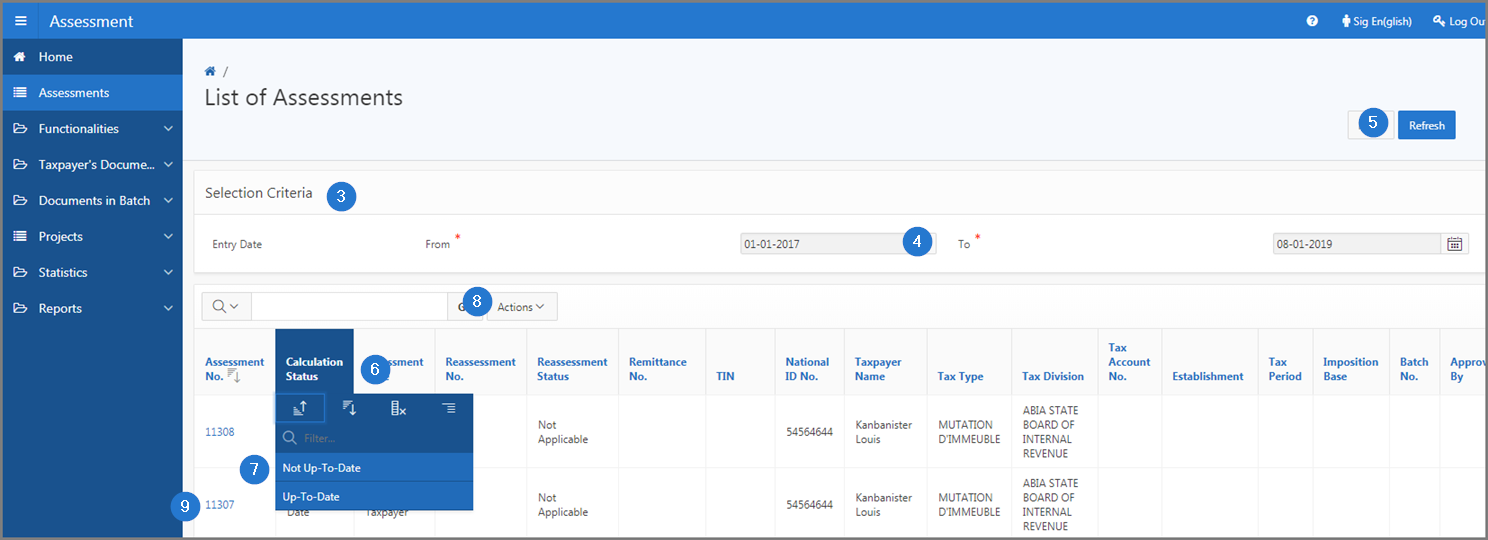

Step 2 - Calculate an assessment

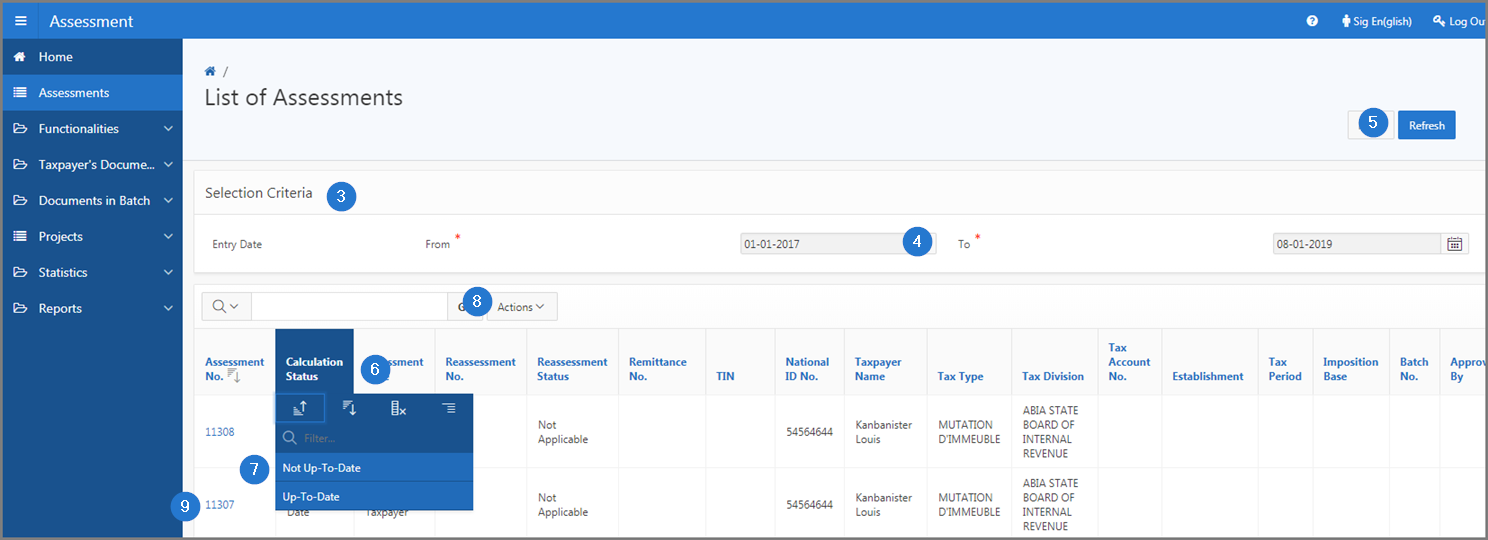

- Go to the Selection Criteria section;

- Fill out the required fields (identified by a red asterisk *). For example, Entry Date, etc.;

- Click the Refresh button. This action refreshes the page and displays the list of assessments in the lower section;

- Go to the Calculation Status column;

- Select the Not-Up-To-date option. This action displays all the assesments with this status;

- Find the appropriate assessment;

- Click the hyperlink of the Assessment No. subject of the request. This action opens the Manage Assessment page (502:2005);

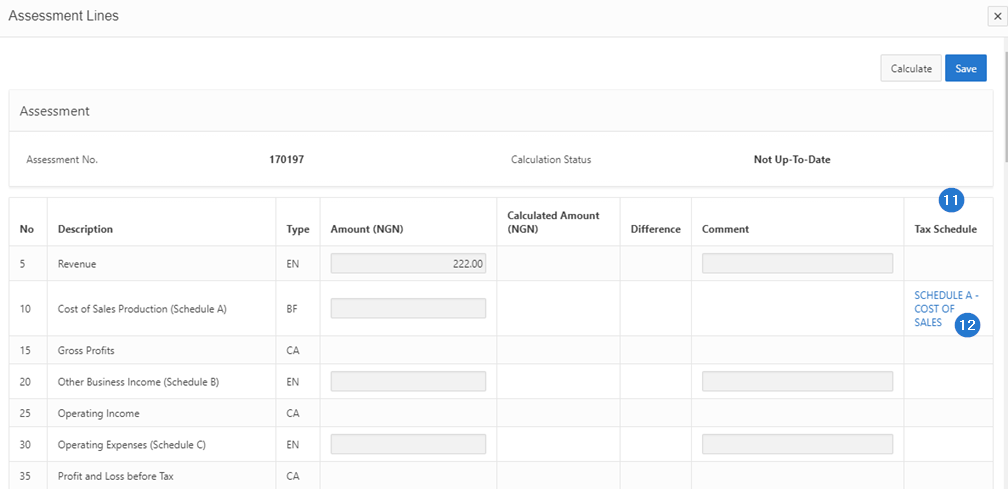

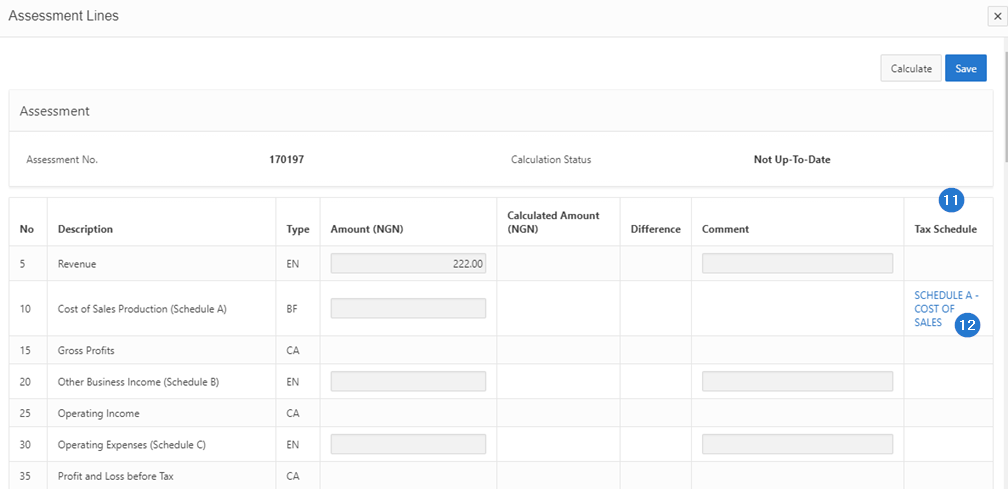

- Click the Show Assessment Lines button. This action opens the pop-up window Assessment Lines;

- Go to the Tax Schedule column;

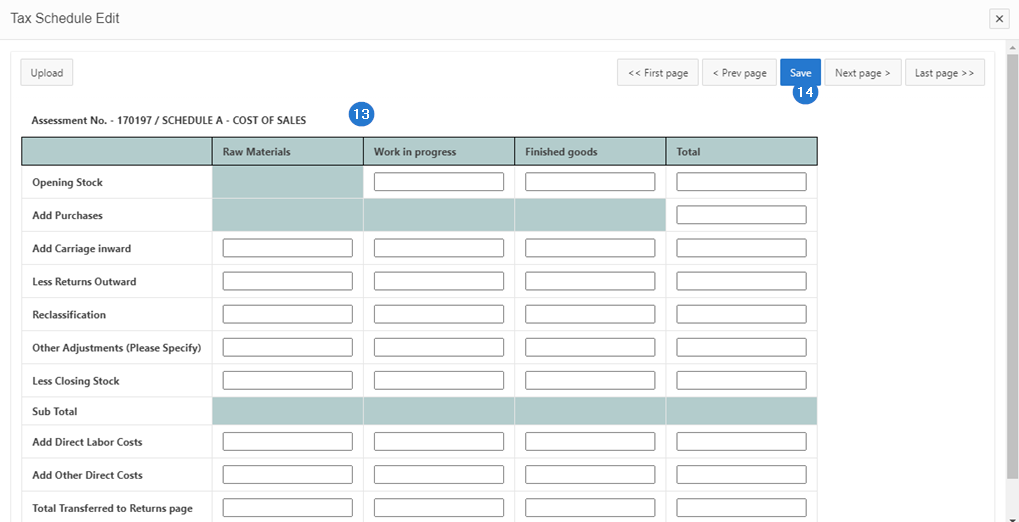

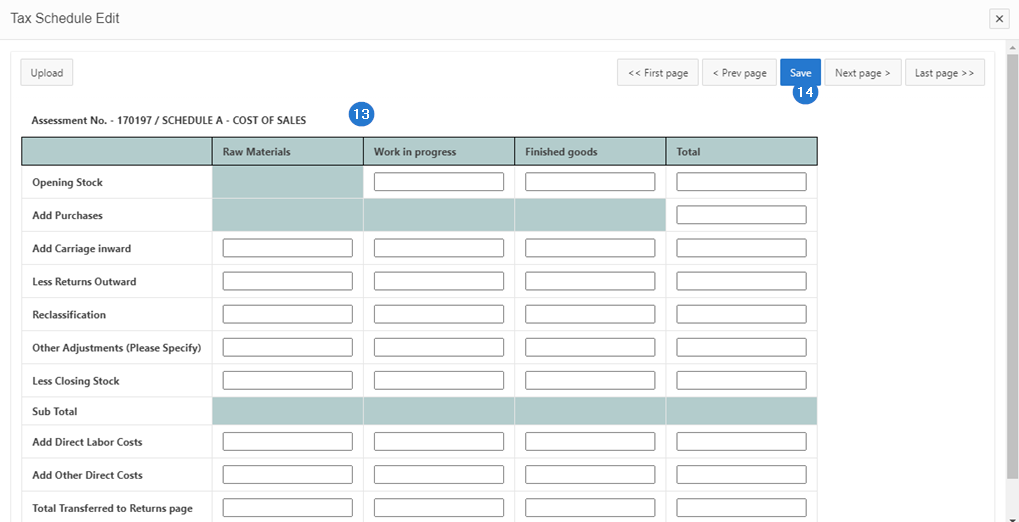

- Click on the tax schedule hyperlink subject to the modification.This action opens the pop-up window Tax Schedule Edit;

- Apply the changes;

- Click the Save button. This action changes the tax schedule and redirects you to the Manage Assessment page (502:2005).