This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to manage properties. It explains how to create new properties, associate parts of properties, assign tax codes, tax rates and tax rules. It also shows how to generate assessment and reassessment notices pertaining to a property.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to manage properties. It explains how to create new properties, associate parts of properties, assign tax codes, tax rates and tax rules. It also shows how to generate assessment and reassessment notices pertaining to a property.

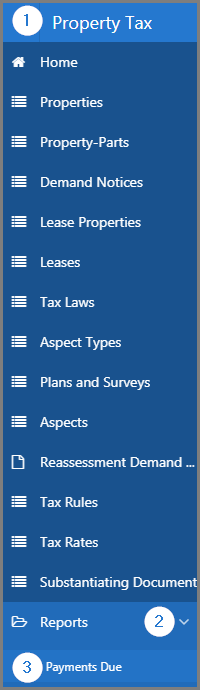

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Property Tax module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, since they apply the same way to all pages. However, these functionalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access the guides, click on the desired link.

• Aspects • Aspect Types • Demand notices • Government Leases • Government_lease • Plans and Surveys • Private Leases • Properties • Property-Parts • Property parts • Substantiating Documents • Tax Laws • Tax Rates • Tax RulesSIGTAS provides users with a series of interactive reports allowing to generate data according to various parameters. To learn how to generate and print interactive reports, click on the following link Interactive Reports.

To access the reports:

The report in the Property Tax module is: