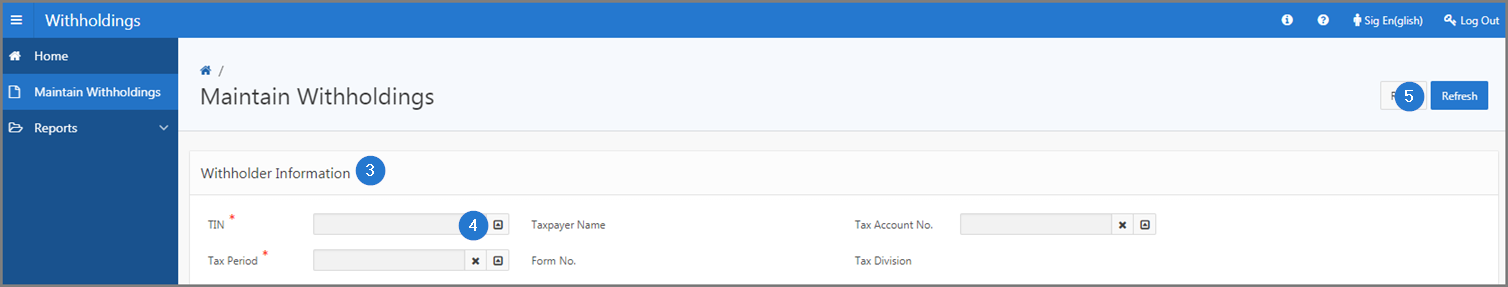

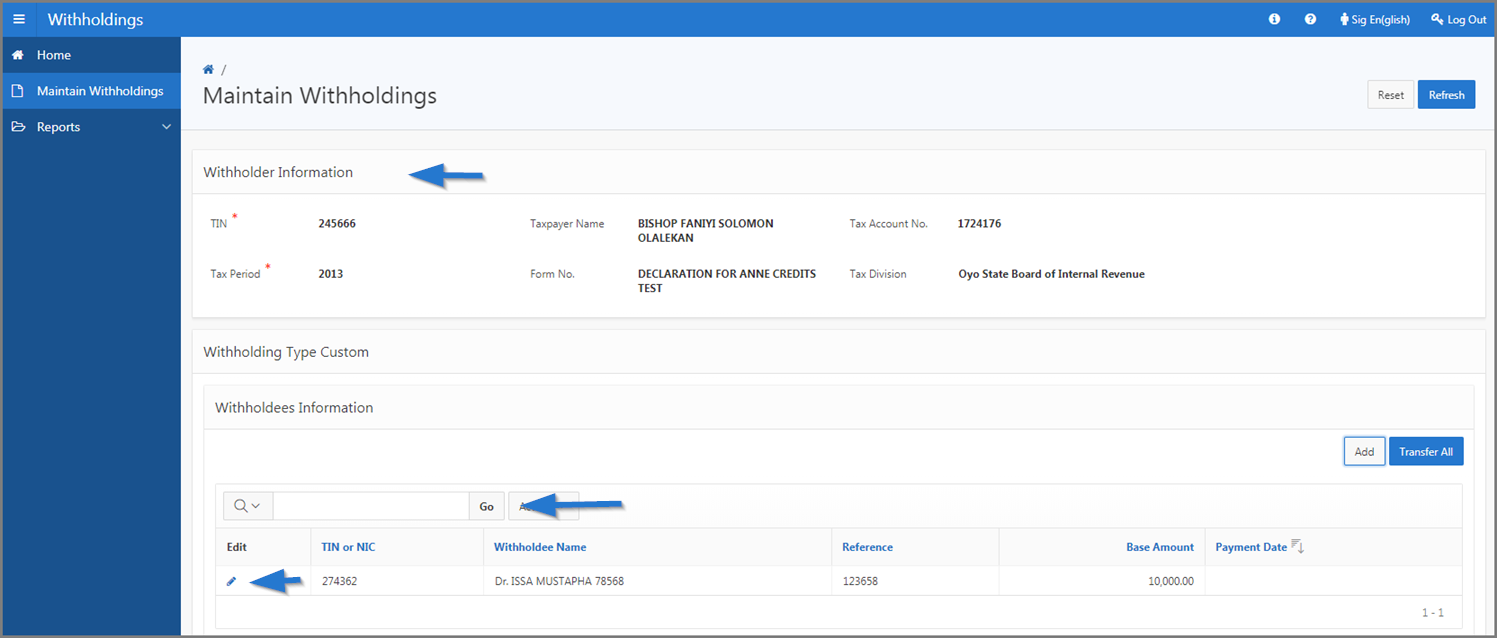

This part of the guide explains how to display withholdings. Make sure the TIN, the tax account and the tax period are associated with the tax type corresponding to the withholdings you want to transfer. In this example, it corresponds to the custom import withholdings.

SIGTAS supports 5 types of withholdings, those related to employee contributions (PAYE), custom imports, third parties, treasury and value added tax (VAT). The user must associate the corresponding tax type with the withholdings listed above, to interact on this page.

The following example demonstrates how to display custom import withholdings. This procedure is standardized and applies also to the other types of withholdings, either employee contribution (P.A.Y.E.), third parties or value added tax (VAT).