Add family information to an individual taxpayer

This part of the guide explains how to add family information to an individual taxpayer.

Step 1 - Go to the page List of Taxpayers

- Go to the Tax Roll module;

- Choose the Taxpayers menu. This action opens the List of Taxpayers page (501:9000);

Step 2 - Choose the taxpayer

- Go to the Criteria section;

- Choose the Individual option;

- Find the individual you want to add the family information to;

- Click on the TIN of the individual subject of the request. This action opens the Individual page (501:2014);

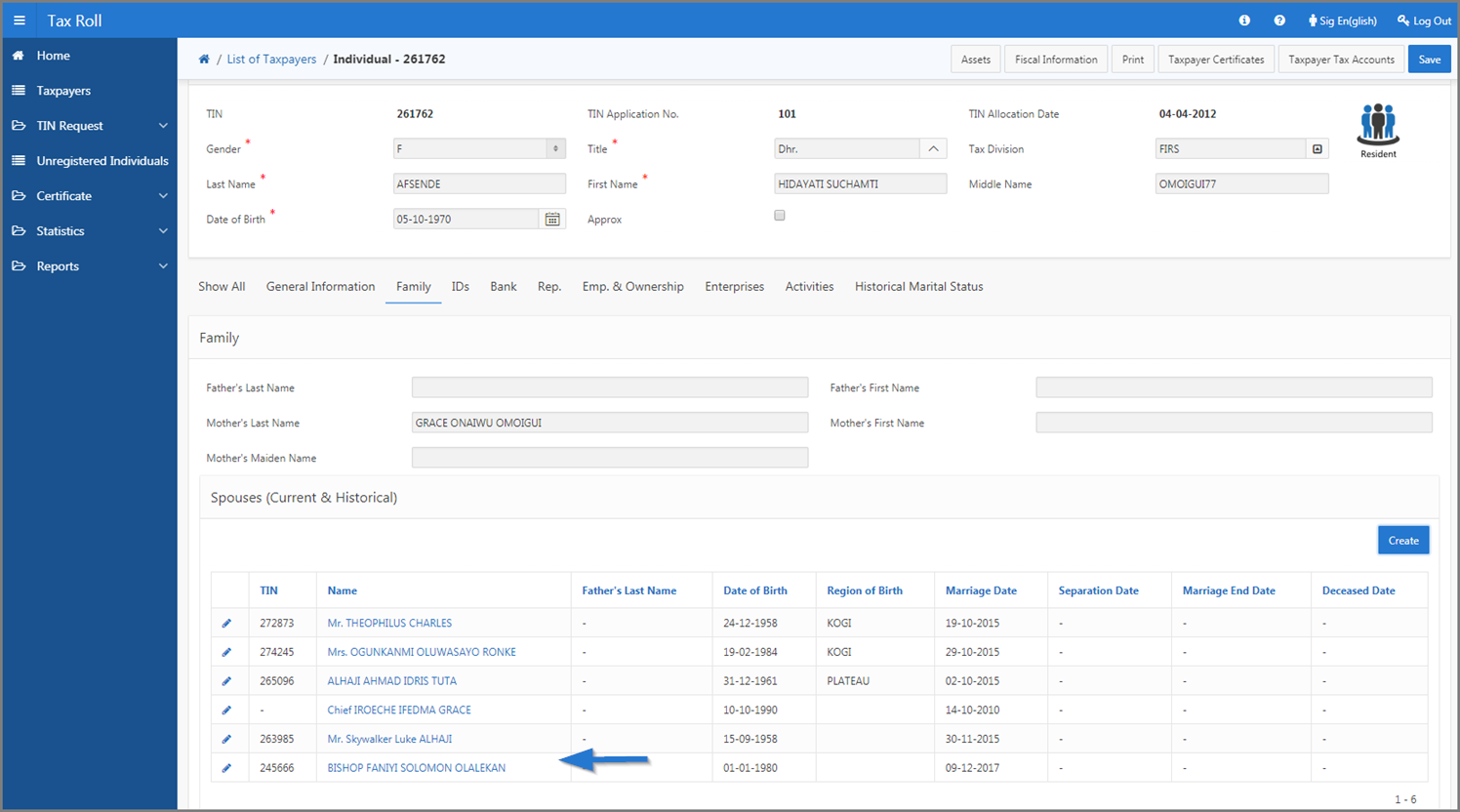

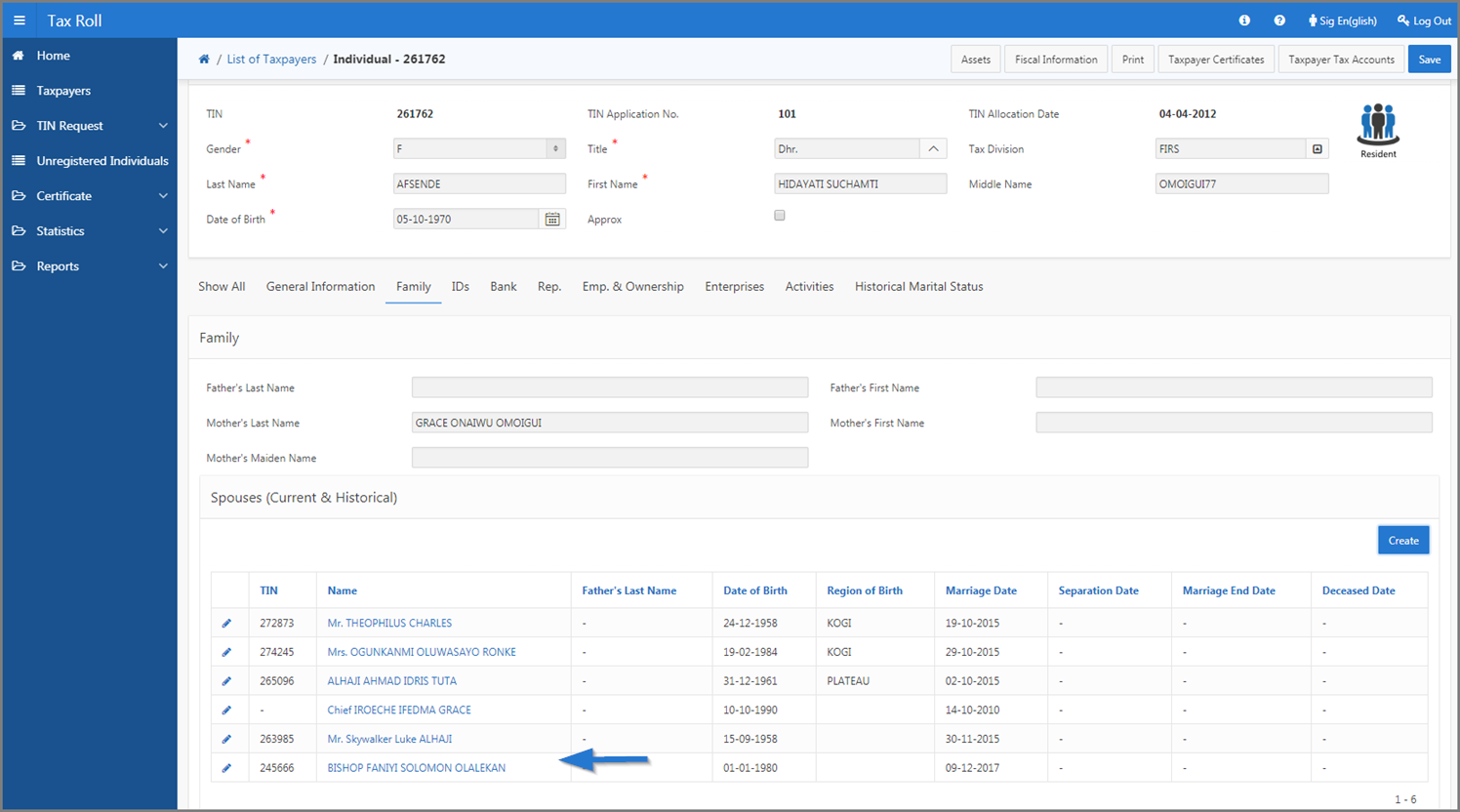

Step 3 - Add family information to an individual

- Go to the Family section;

- Choose the Spouses (Current & Historical) menu;

- Click the Create button. This action opens the pop-up window Spouse;

- By using the radio button, choose Registered or Unregistered, as appropriate;

- Fill out the required fields (identified by a red asterisk *). For example, Last Name, First Name, etc.;

- Click the Save button. This action confirms the addition of family information and updates the Individual page (501:2014);

Step 4 - Add (a) dependent(s)

- Go to the Dependents section;

- Click the Create button. This action opens the pop-up window Dependent;

- By using the radio button, choose Registered or Unregistered, as appropriate;

- Fill out the required fields (identified by a red asterisk * ). For example, TIN, Type, etc.;

- Click the Save button. This action confirms the addition of the dependent and updates the Individual page (501:2014).