This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to manage refund applications. It explains how to save, pre-authorize, approve, reject, or transfer a refund application. It also describes how to create, validate and approve a tax certificate or how to print reports.

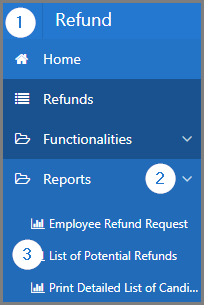

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Refund module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, as they function the same way for all pages in all modules. However, these functionalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access the guides, click on the corresponding link:

• Functionalities • RefundsSIGTAS provides users with a series of interactive reports making it possible to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports.

To access the reports:

The reports of the Refunds module are: