Calculate penalty and interest

This part of the guide explains how to calculate penalty and interest. This page contains some validations. Click the following link for more information : Calculate Penalty and Interest - Configuration Details

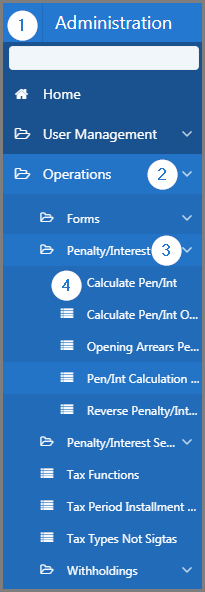

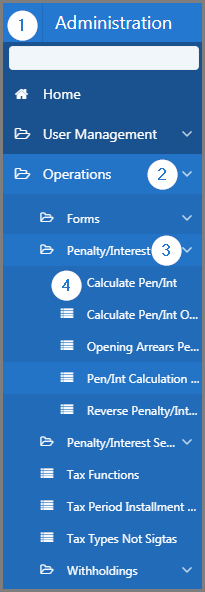

Step 1 - Go to the Penalty and Interest Calculation page

- Go to the Administration module;

- Choose the Operations option;

- Select the Penalty and Interest Calculation option;

- Click the Pen/Interest Calculation menu. This action opens the Calculate Penalty and Interest page (509:15230);

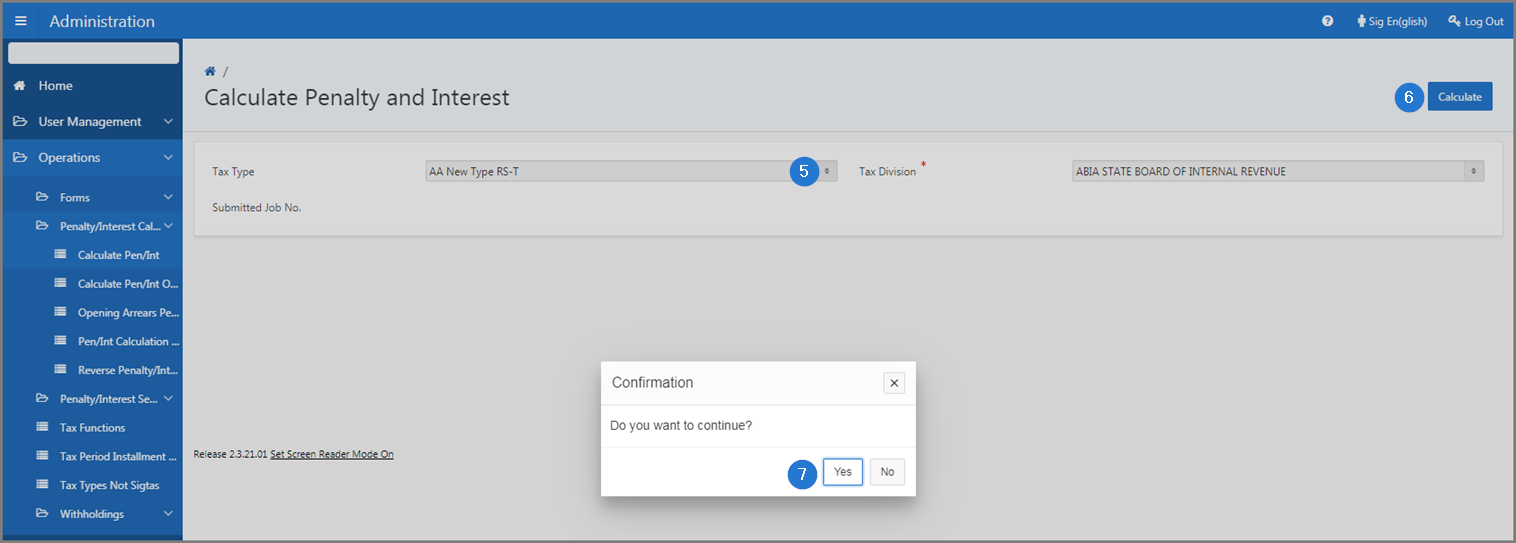

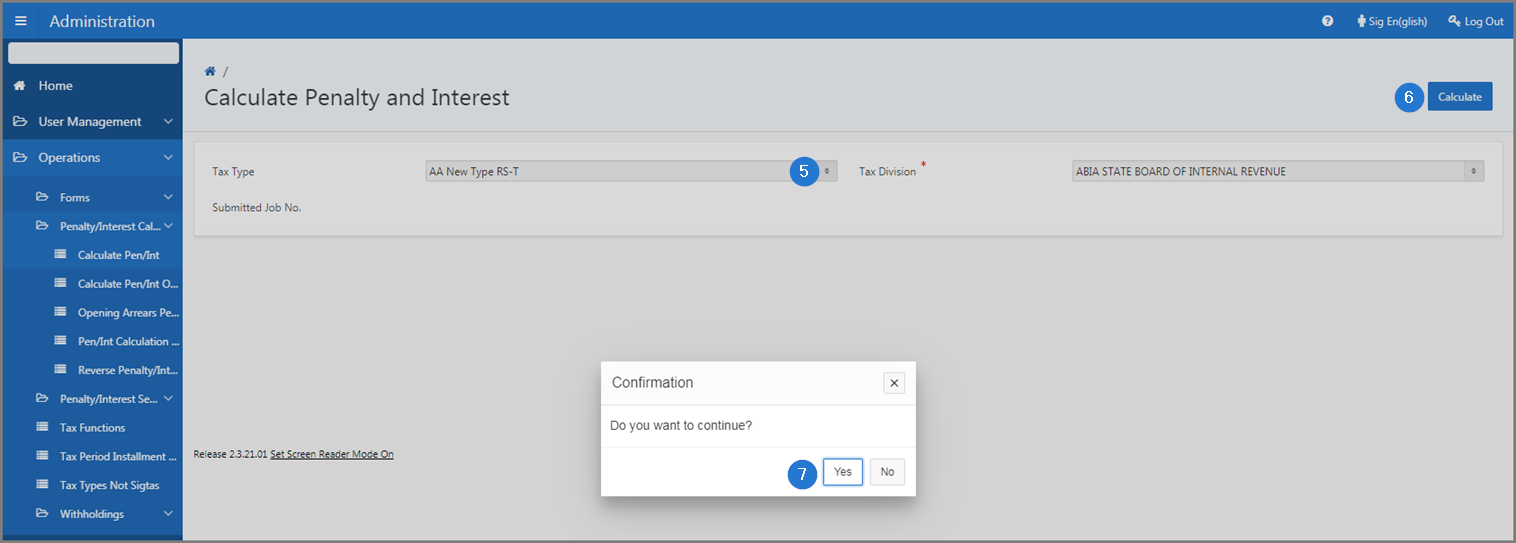

Step 2 - Calculate Penalties and Interest

- Complete the required fields (identified with a red star *). For example, Tax Type, Tax Division, etc.;

- Click the Calculate button. This action opens a confirmation window;

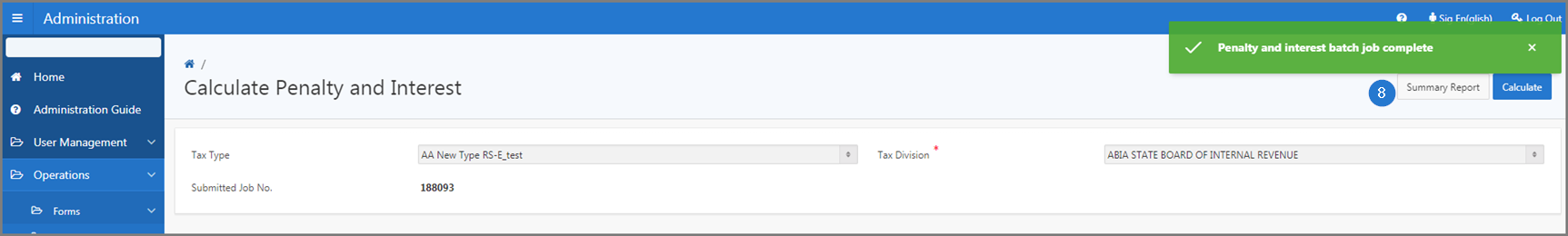

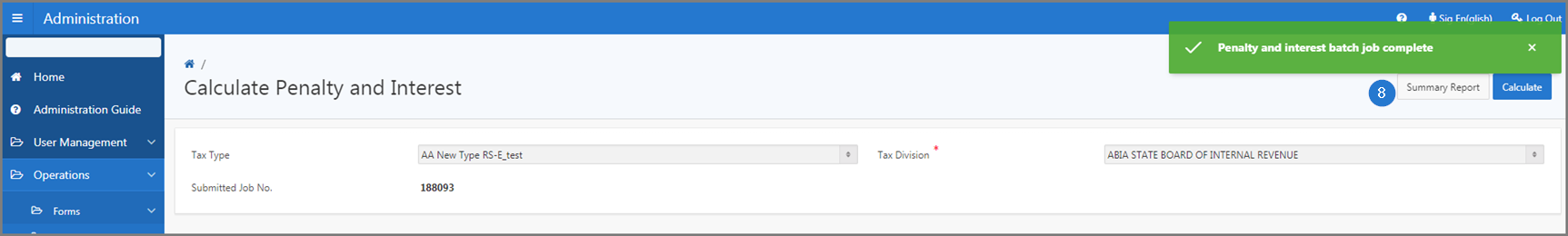

- Click the Yes button. This action calculates the penalties and interests, assigns a task number and displays the Summary Report button;

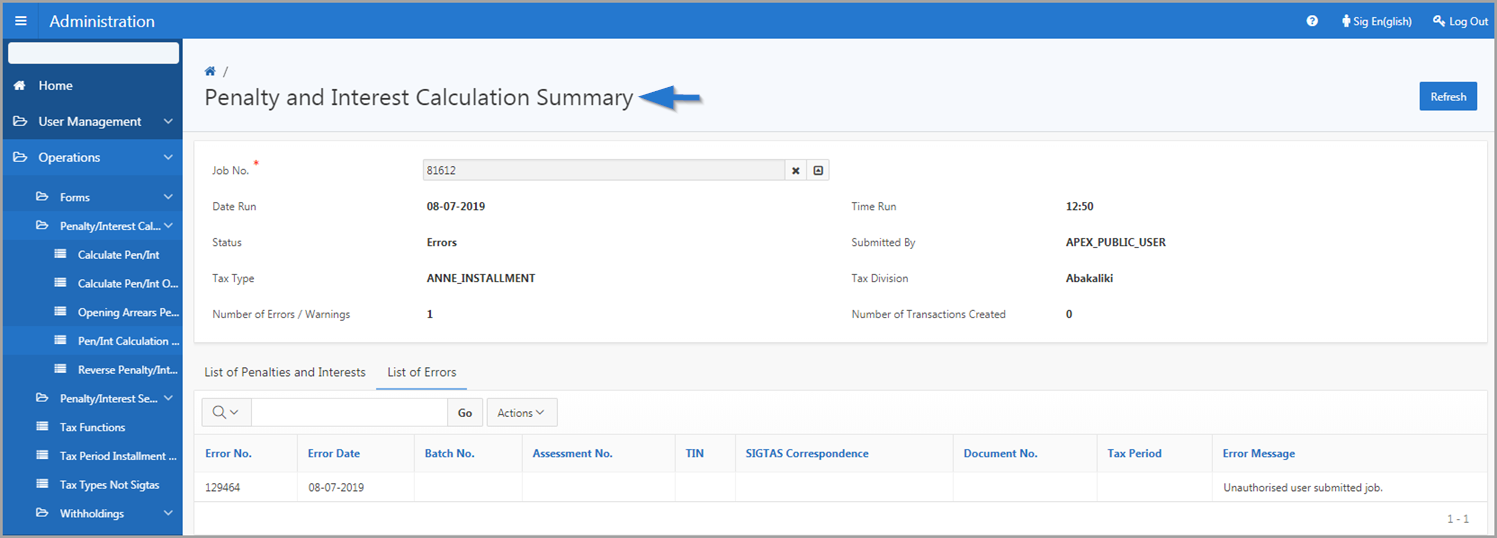

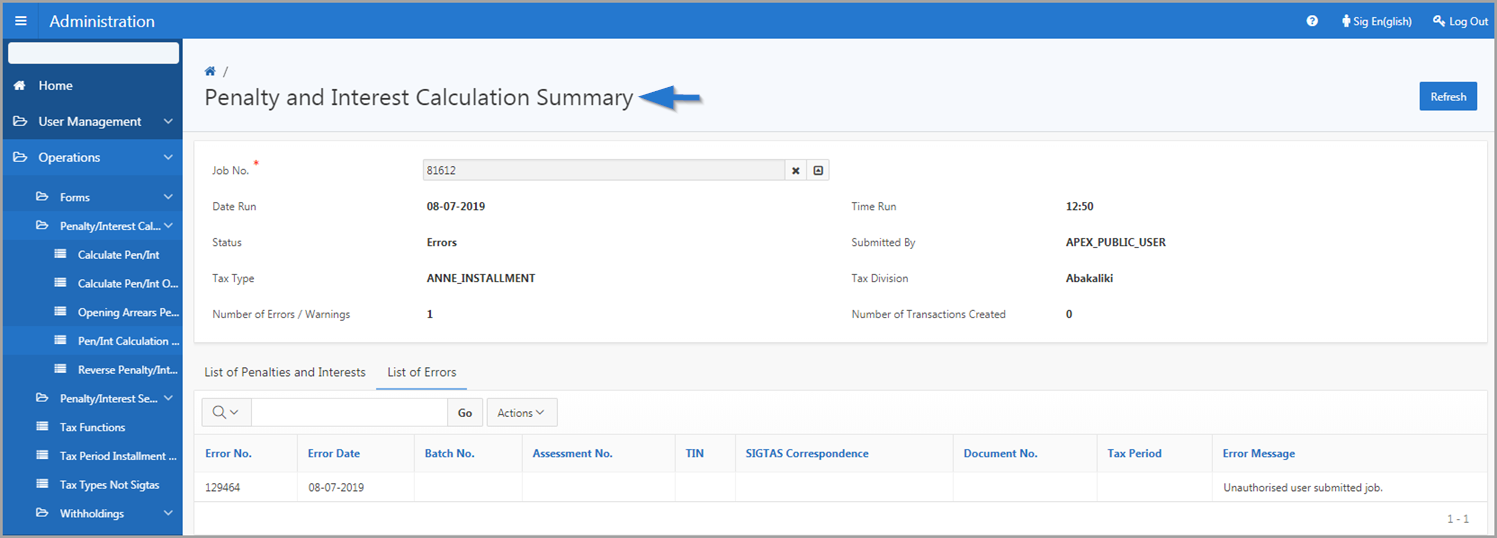

- Click on the Summary Report button. This action redirects you to the Penalty and Interest Calculation Summary page (509:15560). For more information on this functionality, click on the following link: Display penalty and interest calculation summary.