Audit Module

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to create audit cases. It is also used to calculate the risk rating of an audit case, to plan audits and to implement audit programs.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to create audit cases. It is also used to calculate the risk rating of an audit case, to plan audits and to implement audit programs.

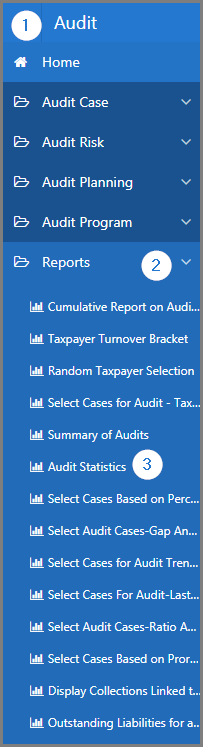

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Audit module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, as they function the same way for all pages in all modules. However, these functionnalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access the guides, click on the corresponding link:

• Audit Cases

• Audit Planning

• Audit Program

• Audit Risk

Reports

SIGTAS provides users with a series of interactive reports making it possible to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports. This module includes five series of reports to be used in conjunction with the Audit Case, Audit Risk, Audit Planning and Audit Program sections as well as the report applied to the Audit module.

The following example demonstrates how to display reports from the Audit Case section. This procedure is standardized and also applies to the reports displayed in the Audit Risk, Audit Planning and Audit Program sections.

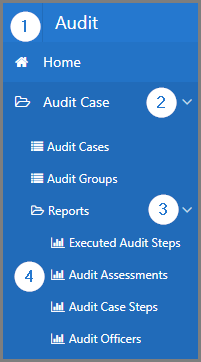

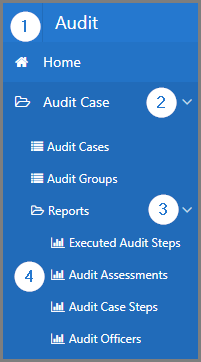

To access the reports in the Audit Case section:

- Go to the Audit module;

- Choose the Audit Case menu;

- Click the Reports option;

- Click on the report you wish to display (in this example: Audit Assessments).

The reports in the Audit Case section are:

- Audit Assessments. This interactive report displays audit assessments based on various search criteria, such as Tax Division, Audit Case No., etc. (505:2010);

- Audit Case Steps. This interactive report displays the audit case steps based on various search criteria, such as Audit Case Step No.,Audit Case No., etc. (505:2020);

- Audit Officers. This interactive report displays the audit officers according to various search criteria, such as Audit Case No., Audit Officer Login, etc. (505:2030);

- Executed Audit Steps. This interactive report displays the audit steps only as per the reference year (505:8000).

The report in the Audit Risk section is:

- Audit Risk Criteria. This report is used to print audit risk criteria based on various search criteria, such as Tax Division, Year, etc. (505:2001).

The reports in the Audit Planning section are:

- Select Cases fot Audit - Impact of Audit. This interactive report displays the cases selected for audit based on various search criteria, such as Tax Division, Tax Type, etc. (505:2042);

- Taxpayer Filing for Consecutive Refunds. This interactive displays taxpayer filing for consecutive refunds based on various search criteria, such as Tax Division, TIN, etc. (505:2041).

The report in the Audit Program section is:

- Taxpayer Account Analysis. This report is used to print a taxpayer account analysis based on various search criteria, such as the TIN, Audit Year, etc. (505:2006).

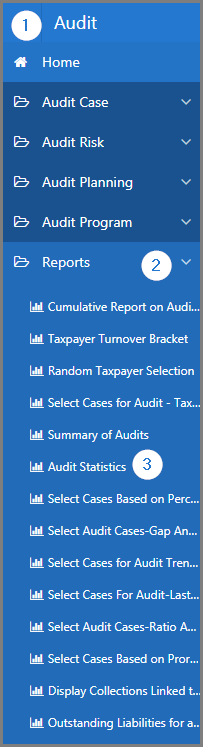

To access the reports in the Audit module:

- Go to the Audit module;

- Choose the Reports menu;

- Click on the report you wish to display (in this example Audit Statistics).

The reports in the Audit module are:

- Audit Statistics. This interactive report displays the audit statistics based on various search criteria, such as the reference period (From - To), Tax Type, etc. (505:2091);

- Cumulative Report on Audit Results. This report is used to print cumulative audit results based on the reference period (Year/Month) and the Audit Type (505:8001);

- Display Collections Linked to Audit. This interactive report displays the linked collections to audit based on various search criteria, such as Tax Division, Payment Date From, etc. (505:3004);

- Outstanding Liabilities for a Taxpayer. This interactive report displays the taxpayer's liability based on various search criteria, such as the TIN, Tax Type, etc. (505:2095);

- Random Taxpayer Selection. This report is used to print a random taxpayer selection based on various search criteria, such as Tax Division, Tax Type, etc. (505:2060);

- Select Audit Cases-Gap Analysis. This interactive report displays gap analysis based on various search criteria, such as Tax Division, Occupation, etc. (505:2092);

- Select Audit Cases-Ratio Analysis. This interactive report displays ratio analysis based on various search criteria, such as Tax Division, Occupation, etc. (505:2096);

- Select Cases Based on Percent Tax Change. This interactive report displays the percent tax change based on various search criteria, such as Tax Type, Form No., etc. (505:2071);

- Select Cases Based on Prorata. This is used to calculated prorata based on various search criteria, such as TIN, Tax Type, etc. (505:9060);

- Select Cases For Audit - Last Audited Tax Period. This interactive report displays the last audited tax period based on various search criteria, such as Tax Type, Tax Division, etc. (505:2094);

- Select Cases for Audit - Taxpayer Size. This interactive report displays the taxpayer size for an audit according to various search ctireria, such as Tax Division, Tax Type, etc. (505:2070);

- Select Cases for Audit Trend Analysis. This interactive report displays the audit trend analysis according to various search ctireria, such as Tax Type, Tax Period, etc. (505:2074);

- Summary of Audits. This interactive report displays the summary of audits based on Start Date, End Date, etc. (505:2090);

- Taxpayer Turnover Bracket.This interactive report displays the taxpayer's turnover bracket based on various search criteria, such as TIN, Taxpayer Name, etc. (505:2050).

- List of Tax Auditors by Audit Case. This report displays the tax auditors by audit case, based on different criteria like the tax division, the audit type, etc. (505:3005)

- Audit Summary Report. This report displays the audit summary report, based on the start date, the end date and the tax division. (505:2097)

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to create audit cases. It is also used to calculate the risk rating of an audit case, to plan audits and to implement audit programs.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to create audit cases. It is also used to calculate the risk rating of an audit case, to plan audits and to implement audit programs.