Cashing Module

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to manage payments. It explains how to display the list of all electronic payments, how to cancel or reverse a payment, how to print a copy of the receipt and how to generate reports.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to manage payments. It explains how to display the list of all electronic payments, how to cancel or reverse a payment, how to print a copy of the receipt and how to generate reports.

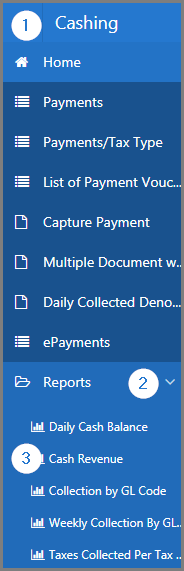

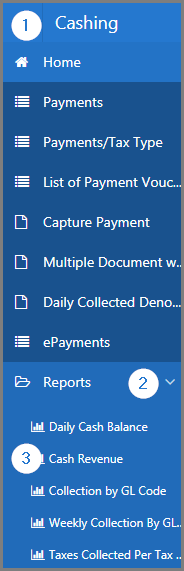

This module is composed of several large sections. Each section is treated individually and presents the main functionalities of the component. This page displays all the functionalities available in the Cashing module. The display order of the sections corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, since they apply the same way to all pages. However, these functionalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access guides, click on the corresponding link:

• Daily Collected Denomination

• ePayments

• Payments

• Payment Vouchers

• Split Tax Type Payment

• Taxpayer balance

Reports

SIGTAS provides users with a series of interactive reports allowing the user to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports

To access the reports:

- Go to the Cashing module;

- Choose the Reports option;

- Click on the report of your choice.

The reports of the Cashing module are (in alphabetical order):

- Bank Transactions Transferred Between Two Dates. This interactive report displays the bank transactions transferred between two dates based on various search criteria, such as Tax Division, Bank, etc. (507:10019);

- Cash Revenue. This interactive report displays cash revenues based on various search criteria, such as Tax Type, Tax Division, etc. (507:10008);

- Collection by GL code. This interactive report displays collection by GL code based on various search criteria, such as Payment Location, Report, etc. (507:10005);

- Daily Cash Balance. This report is used to print the daily cash balance based on various search criteria, such as Cashier Name, Payment Location, etc. (507:10004);

- Deposit Slip. This report is used to print the deposit slips based on various search criteria, such as Entered Date, Cashier's Name, etc. (507:6003);

- Details of a Receipt. This report is used to print the details of a receipt using the receipt No. (507:6002);

- Distribute Arrears. This report is used to print the distribute arrears based on various search criteria, such as Tax Account No., TIN, etc. (507:10000);

- Distribution of Receipts per charge. This interactive report displays distribution of receipts per charge based on various serach criteria, such as Receipt, Tax Trans No, etc. (507:10026);

- List of Bank Payments. This interactive report displays the list of bank payments based on various search criteria, such as Tax Type, Payment Location, etc. (507:10016);

- List of Cancelled Receipts. This interactive report displays cancelled receipts based on various search criteria, such as Payment Location and Date From., etc. (507:10021);

- Maintain Tax Budget. This interactive report displays the details of the maintained tax budget based on various search criteria, such as Tax Type, Tax Division, etc. (507:10018);

- Monthly Cash Revenue Reports. This interactive report displays monthly cash revenue based on various search criteria, such as Tax Type, Tax Division, etc. (507:10017);

- Monthly Tax Collected. This interactive report displays the monthly taxes collected based on various search criteria, such as the reference date (Month, Year), etc. (507:10024);

- Payments between two Dates. This interactive report displays payments between two dates based on various search criteria, such as Document Type, Tax Type, etc. (507:10010);

- Payments by Main Business Activity. This report is used to print payments by main economic activity based on various search criteria, such as Tax Type, Start Date, etc. (507:10007);

- Payments on Support. This interactive report displays payments on support based on various search criteria, such as Date From, To, etc. (507:10025);

- Payment Situation. This report displays the payment situation based on the start date, the tax division and other optional criteria. (507:10001)

- Payments vs Declaration Discrepancy. This report is used to print payments versus declaration discrepancies based on various search criteria, such as Declaration Date From, To, Tax Division, etc. (507:10006);

- Revenue Situation. This interactive report displays the revenue situation based on various search criteria, such as TRO, Payment Location, etc. (507:10003);

- Taxes Collected per Tax Type. This interactive report displays taxes collected based on Start Date, End Date, etc. (507:10009);

- Taxes Collected by GL Code. This report displays taxes collected by GL Code, also based on Start Date, End Date, budget type etc. (507:10029);

- Situation Summary. This interactive report displays situation a summary based on the TIN (507:10027);

- Total by Payment Type and Tax Type. This report is used to print the total by payment and tax type based on various search criteria, such as From, To, etc. (507:6001);

- Undistributed Amount. This report displays the undistributed amount by tax type.(507:10011)

- Weekly Collection By GL Code. This interactive report displays weekly collection based on various search criteria, such as Tax Division, Week1 From, etc. (507:10012).

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to manage payments. It explains how to display the list of all electronic payments, how to cancel or reverse a payment, how to print a copy of the receipt and how to generate reports.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities enabling the user to manage payments. It explains how to display the list of all electronic payments, how to cancel or reverse a payment, how to print a copy of the receipt and how to generate reports.