Cross-checking Module

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to load data into SIGTAS.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to load data into SIGTAS.

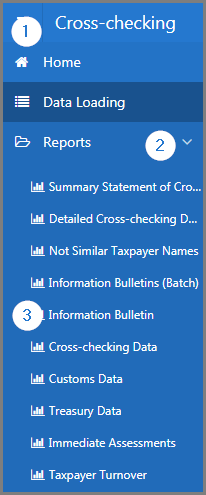

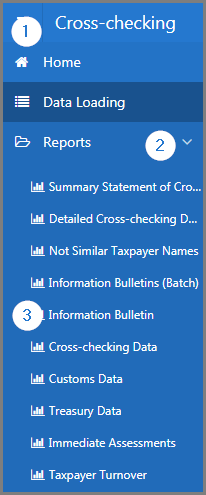

This page displays all the functionalities available in the Cross-checking module. The display order of the section corresponds to that of SIGTAS (left section of the home menu).

In order to lighten the content of the guides, the following sections do not document the procedures for closing, modifying, and deleting, since they apply the same way to all pages. However, these functionalities are described in more detail in the Close, Edit, and Delete section of the About SIGTAS guide.

To access the guide, click on the following link:

• Data Loading

Reports

SIGTAS provides users with a series of interactive reports making it possible to generate data according to various parameters. To learn how to generate and print interactive reports, click the following link: Reports.

To access the reports:

- Go to the Cross-checking module;

- Choose the Reports option;

- Click on the report you wish to display.

The reports in the Cross-checking module are:

- Cross-checking Data. This report is used to print cross-checking data according to various search criteria such as Source Type, TIN, etc. (540:2110);

- Customs Data. This interactive report displays customs data based on various search criteria such as Year, TIN, etc. (540:1006);

- Detailed Cross-checking Data. This report is used to print detailed cross-checking data according to various search criteria such as Source TIN, Operation Nature, etc. (540:1005);

- Immediate Assessments. This interactive report displays immediate assessments based on various search criteria such as Employee Type, Tax Type, etc. 540:1030);

- Information Bulletin. This report is used to print the information bulletin according to various search criteria such as TIN, Start Date, etc. (540:2100);

- Information Bulletins (Batch). This report is used to generate information bulletins in batch according to various search criteria such as Tax Division, Start Date, etc. (540:2000);

- Not Similar Taxpayer Names. This report is used to print not similar taxpayer names according to the TIN (540:1011);

- Summary Statement of Cross-checkings. This interactive report displays the summary statement of cross-checking based on various search criteria such as TIN, Taxpayer Name, etc. (540:1004);

- Taxpayer Turnover. This interactive report displays taxpayer turnover based on various search criteria such as Employee Type, Tax Type, etc, (540:2121);

- Treasury Data. This interactive report displays treasury data based on various search criteria such as Year, *Tapayer's Name, etc. (540:1020).

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to load data into SIGTAS.

This guide is intended primarily for the user of SIGTAS. It details the procedures and functionalities making it possible to load data into SIGTAS.